Hi everyone,

A warm welcome to the 50 new subscribers who joined us this week! As we continue building out this newsletter, we’re excited to roll out new features—so stay tuned. In our weekly Sunday posts, we’ll continue to be spotlighting some companies with upcoming earnings reports for this week. For each one, we’ll break down recent achievements or headlines, analyze their 2025 financial outlook using the latest data, and share our take on where we think the stock could be headed over the next 6 to 12 months.

Please make sure to move this newsletter into your “Primary” folder within your email!

We also wanted to bring to everyone’s attention our referral program at the bottom of the page. For just two referrals to your friends and family you will receive an email that grants you access to our LIVE STOCK TRACKER, where we will be logging every stock that we will be talking about on this newsletter, which will allow you to stay up to date and never miss a beat even during busy work weeks. We are up currently over 10% on our stock pick from last week $HOOD, so check it out!

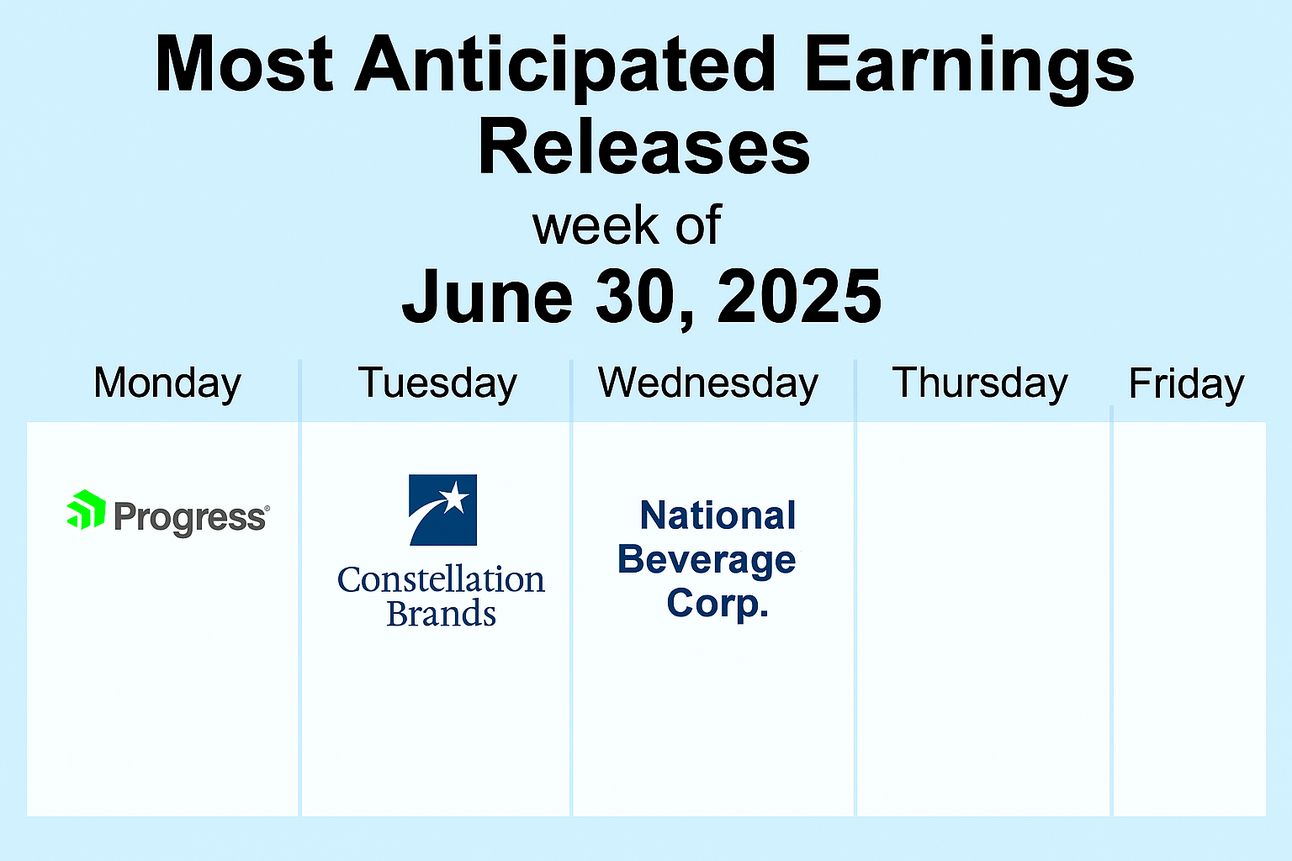

Weekly Earnings Spotlight: June 30-July 3, 2025:

Monday June 30th: Progress Software Corporation (PRGS)

Tuesday July 1st: Constellation Brands (STZ)

Wednesday July 2nd: National Beverage Corp (FIZZ)

We’re only focusing on three companies this week, as it’s a relatively quiet period for earnings.

Progress Software Corporation (PRGS)

Earnings Date: June 30th (After market)

Progress Software helps businesses build and manage powerful applications using AI-driven tools. Their products—like OpenEdge, Sitefinity, and MOVEit—are designed to simplify everything from app development to data sharing and security. They focus on making it easier for companies to connect systems, protect information, and deliver smooth digital experiences.

Recent Highlights:

Progress recently completed the acquisition of ShareFile on October 31, 2024, adding a SaaS-native, AI-powered, document-centric collaboration platform to its portfolio. This strategic move is expected to enhance revenue growth and operating margins, with ShareFile delivering results in line with expectations in Q4 2024. We personally love to see when a company is continuously acquiring other companies, which shows strong growth and a larger capital expenditure. On the debt side, in Q1 2025, they accelerated repayment of $30 million of the revolving credit line used for the ShareFile acquisition and repurchased $30 million of its shares, which demonstrates financial discipline and commitment to shareholder value. These are both a great sign for the companies growth and ability to pay back debt, which will in turn make it easier to obtain loans in the future.

Financial Guidance for 2025:

Progress reported a 29% year-over-year revenue increase to $238 million and a 48% rise in Annualized Recurring Revenue (ARR) to $836 million in Q1 2025. Non-GAAP diluted earnings per share grew 5% to $1.31. They are being covered by multiple analysts, with a consensus leaning toward a "Buy" or "Strong Buy" rating. Analyst price targets range from $65 to $83 per share, suggesting a potential upside of approximately 3% to 32% from the stock price of $63.01 as of June 18, 2025. Something we are looking at is the positive Zacks Earnings ESP of +0.46% and a Zacks Rank #3 (Hold) for Q2 2025, which indicates to us a high likelihood of another earnings beat on July 1, 2025.

Stock Outlook:

We personally think that Progress Corporation is setting itself up for success. The positives above that we highlighted check off all of the boxes for us. The ability to pay back debt early, the ability to beat earnings, and continued growth in mergers and acquisitions show a great trajectory for the stock. When zooming out on the stock to the 5 year chart, the stock has grown around 72%, which shows steady growth and offers a small dividend yield of 1.1%. We currently hold a small position in PRGS in our portfolio, attracted by its steady growth and consistent dividend payouts. We're keeping an eye out for any pullbacks as a potential opportunity to add to our position.

Constellation Brands (STZ):

Earnings Date: July 1st (After market)

Constellation Brands, Inc. is a leading international producer and marketer of beer, wine, and spirits, with a portfolio of over 100 premium brands, including Corona, Modelo, Robert Mondavi, and Casa Noble, operating in the U.S., Mexico, New Zealand, and Italy. The Fortune 500 company, based in Rochester, New York, is the largest beer importer in the U.S. and focuses on building brands that elevate human connections through sustainable and responsible practices.

Recent Highlights:

In April 2025, Constellation Brands signed an agreement with The Wine Group to divest primarily mainstream wine brands and related facilities, focusing its wine portfolio on higher-growth, higher-margin brands priced above $15, such as Robert Mondavi Winery, Kim Crawford, and The Prisoner Wine Company. The transaction, expected to close after Q1 FY2026, aims to streamline operations and enhance profitability

Financial Guidance for 2025:

In February 2025, Constellation announced the redemption of 4.75% Senior Notes due 2025 and 5.00% Senior Notes due 2026, reflecting sound debt management. The company also authorized a new three-year $4 billion share repurchase program and maintains a 3% dividend payout ratio to maximize shareholder value. In January 2025, Constellation trimmed its FY2025 organic net sales growth forecast to 2–5% from 4–6%, reflecting cautious consumer spending. For FY2026, beer net sales growth is projected at 0–3%, with medium-term (FY2027–FY2028) beer sales growth revised to 2–4%, targeting $9 billion in operating cash flow and $6 billion in free cash flow by FY2028. This is something we are keeping an eye on, as any trimming in sales growth forecast is a bad sign for a company.

Stock Outlook:

It is well worth noting that Constellation Brands pays a quarterly dividend of $1.01 per share of Class A Common Stock, with the most recent payment declared on January 8, 2025, payable on February 21, 2025, to shareholders of record as of February 7, 2025. Annualized this is about $4.05 per share. This being said, the last 5 years chart of Constellation brands has not been great. They have seen a 10% drop in the stock price over this time and continue to lose more and more market share. We're staying on the sidelines with this stock for now, as we're waiting to see clear signs of a market rebound and a stronger commitment to increasing shareholder returns through dividends.

National Beverage Corp (FIZZ)

Earnings Date: July 2nd (After market)

National Beverage Corporation is a major U.S. developer, manufacturer, and distributor of flavored non-alcoholic beverages, including sparkling waters, juices, energy drinks, and soft drinks, with popular brands like LaCroix, Shasta, and Faygo. They focuse on innovative, health-conscious products and sustainable practices, serving a diverse consumer base through multiple distribution channels.

Recent Highlights:

In February 2025, LaCroix Sparkling Water introduced "Sunshine," a new flavor innovation, and in August 2024, launched "Strawberry Peach," enhancing its health-focused portfolio. Additionally, LaCroix announced a multi-year partnership with the Kansas City Current, a women’s professional soccer team, to expand brand visibility and engage health-conscious consumers. The trend within the markets and throughout the United States since Covid has been all about getting back into shape and focusing on health conscious choices. National Beverage Company continuing to focus on seltzer water is a great step in the right direction.

Financial Guidance for 2025:

National Beverage Corp. reported a 1.9% increase in net sales to $297.3 million for the second quarter ended October 26, 2024, with net income rising 4.2% to $40.7 million, driven by innovation and improved operating margins. For the six-month period, net sales grew 1.8% to $626.8 million, and net income increased 6.2% to $90.5 million, reflecting strong consumer demand for its Power+ Brands. They reported a 1.9% increase in net sales to $297.3 million for Q2 FY2025 and a 1.8% increase to $626.8 million for the first six months. The company emphasized continued innovation and consumer demand for its Power+ Brands (e.g., LaCroix, Rip It), suggesting a stable outlook for sales growth, though specific revenue projections for FY2025 were not disclosed

Stock Outlook:

Over the last year the stock has not done great. It is currently down from its yearly high of 52.80 all the way down to 43.14. The 5 year chart still shows a gain of around 35%, which compared to the S&P 500 is not great. They also currently do not offer any dividends, which should be a sign that they are continuing to grow and spend capital but this does not seem to be the case. We currently do not hold a position in FIZZ and do not plan to change our stance anytime soon.

A quick read this week, we know—earnings are light. But stay tuned! On Tuesday, we’ll be sending out an analysis of a stock we believe has strong long-term potential, followed by our Friday market recap to close out the week.

In the coming weeks we are going to provide an option for you to see directly what our portfolio consists of and how we divide into a good balanced portfolio for long term growth!

Disclaimer: This information is not financial advice. The information provided in this newsletter is for educational and informational purposes only and should not be considered financial or investment advice. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions. Investments involve risk, and past performance is not indicative of future results.