Hi everyone,

Welcome aboard, and thank you for joining us! We’re thrilled to kick things off and can’t wait to see where this journey takes us. In the coming weeks, we’ll be introducing some exciting new features, where you can follow our portfolio and in-depth dives into our top stock picks.

For today, and most Sundays, we’ll focus on companies reporting earnings in the upcoming week. With many to choose from, we’ll pick those we believe are the most important or interesting. For each, we’ll spotlight key achievements or developments from recent months, provide an analysis of their 2025 financial outlook based on the latest data, and share our perspective on where we think their stock might head over the next 6–12 months.

Please make sure to move this newsletter into your “Primary” folder within your email!

Weekly Earnings Spotlight: June 23-27, 2025:

Tuesday June 24th: Carnival Corporation (CCL)

Tuesday June 24th: FedEx Corporation (FDX)

Wednesday June 25th: Micron Technology (MU)

Wednesday June 25th: General Mills (GIS)

Thursday June 26th: Nike (NKE)

Carnival Corporation (CCL)

Earnings Date: Tuesday June 25th 2025 (After market close)

We are sure you have likely heard of or even sailed with Carnival Corporation (CCL) before. As the world’s leading cruise operator, Carnival oversees five distinct cruise lines globally and manages a fleet of 94 ships as of this newsletter.

Recent Highlights:

Looking at some cool things Carnival is doing, they just announced an update to their rewards loyalty program—something members have been eager to see. The company’s financial momentum is equally impressive, as Carnival had $25 billion in full-year 2024 revenue, up 15% from the prior year, driven by demand. The company outperformed its guidance in 2024 by $130 million, posting a $1.9 billion adjusted net income, while slashing debt by $7.3 billion since 2023. A smart move came with their strategic tie-up with J.P. Morgan, which co-led a $1.25 billion common stock offering in March 2020, bolstering liquidity during tough times—a critical step given Carnival’s hefty debt load, which they’re now steadily chipping away at.

Financial Guidance for 2025:

Carnival expects a strong 2025, with revenue projected at $25.5–$26 billion, fueled by record bookings and high pricing. Adjusted EBITDA per ALBD targets a near-20-year high, with ROIC at 12%. Interest expense should drop $200 million from 2024, supported by a $5.5 billion refinancing, aiming for a debt-to-EBITDA ratio below 4.5x. Capex is set at $1.1 billion for newbuilds and $2.5 billion otherwise. Compared to peers, Carnival’s revenue growth tops Royal Caribbean’s 18–20% to $19.5–$20 billion, though Royal Caribbean’s ROIC (14%) and 12% passenger growth edge out. Norwegian Cruise Line projects $9.8–$10 billion (up 10–12%), with leaner costs ($213 vs. Carnival’s $215 per passenger day). Despite fuel and spending risks, Carnival’s demand remains solid.

Stock Outlook:

Carnival’s stock currently trades at $23.66, with analysts projecting a rise to around $28, suggesting a potential $4 per-share gain. While this could very well be the case we are staying optimistic. One of our biggest things we like to look at is comparisons with similar companies. With a P/E ratio of 15.50, it sits well below the S&P 500’s approximate 22, indicating undervaluation. Royal Caribbean sits at 21.3 P/E ratio and Norwegian Cruise line at 10.31. We anticipate that the stock sits around these levels and beats earnings. We currently do not hold a position in Carnival and we are avoiding buying anytime soon due to the ongoing global tensions and potential economic slowdown that may effect the travel sector.

FedEx Corporation (FDX)

Earnings Date: Tuesday June 25th 2025 (After market close)

FedEx Corporation (FDX) is the global leader in transportation, e-commerce, and logistics, and provides a range of delivery options including ground, air, and sea transportation of goods.

Recent Highlights:

As you well know FedEx has long faced challenges from companies like Amazon and UPS, who have invested heavily into automation throughout the years, with Amazon seemingly taking a bigger market share every year. Fedex has the goal of being carbon-neutral by 2040 with more automation through electric vehicles and automation in warehouses. We choose to focus on FedEx this week for the overall broader economy, because when a company like FedEx produces better then expected earnings, we could assume that the amount of deliveries increases, which comes from more consumers purchasing goods from various parts of the country and the world. In a pivotal time in tariff talks, focusing on a company who’s main driver of revenue is the shipment of goods is very important.

Financial Guidance for 2025:

FedEx expects a flat to slightly down year over year revenue forecast due to global trade uncertainties revolving around tariff talks, as well as softness in the US global demand of goods. Guidance continues to price in the loss of the contract with the US postal service, which accounted for 180 million dollars of operating income per quarter for the company.

Stock Outlook:

Historically, the day that FedEx reports earnings, the stock has seen an 11% swing. With the current fears in the market and the possible guidance discussion about the July 9th trade deadline, we are staying out of this possible massive downturn. We currently see FedEx as a wait and see stock, using its earnings on Tuesday to help predict where the economy is heading and using this as a leading indicator of an economic downturn if revenue falls short of expectations. If they do end up seeing a drop come Tuesday, it would be very enticing for us to enter into the stock given the companies 2.48% dividend yield and continued growth since 2001. We currently have higher dividend yield stock within our portfolio are better and you will have the opportunity of gaining access to it.

Micron Technologies (MU)

Earnings Date: Wednesday June 25th (After Market Close)

Micron Technologies is a leading global semiconductor company that designs, manufactures, and sells memory storage products. Micron develops cutting edge memory technologies like high bandwidth memory for AI and high performance computing. Micron is a key player in the semiconductor industry, powering memory and storage needs of modern technology.

Recent Highlights:

Micron recently announced a $200 billion investment aimed at strengthening U.S. semiconductor manufacturing and research & development. This strategic move positions Micron to better withstand global supply chain disruptions, tariff risks, and geopolitical tensions—especially in light of increasing concerns around chip security and international conflict.

Financial Guidance for 2025:

UBS recently raised its price target from 92$ to $120 on June 5th, citing stable demand, while Citi upped their price target to around $130 on June 9th, citing stronger pricing and the continued need for semiconductor chips. Recently, Micron was selected by NVIDIA as the first supplier for its next generation memory solution, enhancing its competitive edge in AI server memory over rivals like Samsung. For the 3rd quarter of 2025, Micron expects record quarterly revenue driven by strong demand for their product in data centers all around the world.

Stock Outlook:

Given Micron’s earnings volatility, the trailing twelve-month (TTM) P/E ratio offers a more grounded valuation perspective. Currently, Micron trades at a TTM P/E of 25.98, slightly below the industry average of 26.2. In contrast, peers like NVIDIA, AMD, and Broadcom trade at a significantly higher average P/E of 73.5, reflecting heightened AI-driven investor optimism.

We maintain a bullish long-term outlook on AI and its transformative impact across industries. The semiconductor sector is foundational to this growth and, in our view, should comprise 5–10% of a diversified portfolio. We currently sit with NVIDIA taking most of our AI diversified portfolio and currently have some Micron shares around 2-3% of our portfolio around $96. Out of these 5 stocks we are talking about this is our favorite one and we think we see a price of $150 in the next 6-12 months.

General Mills (GIS)

Earnings Date: Wednesday June 25th (After market close)

General Mills is a global food company that manufactures and markets branded consumer foods. It produces a wise range of products, including cereals, snacks, yogurt, and baking mixes, and is sold in more then 100 countries.

Recent Highlights:

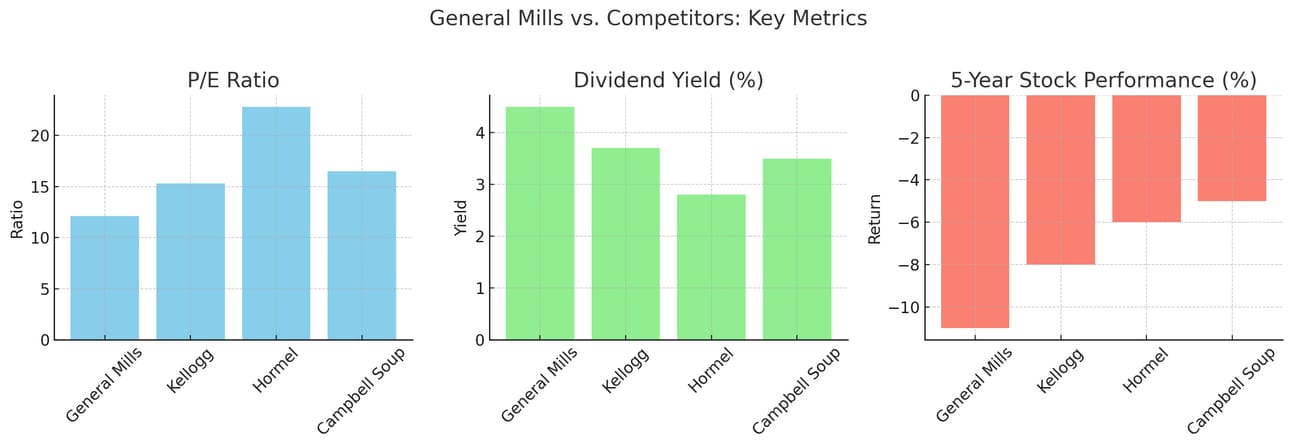

By the end of 2027, General Mills plans to eliminate artificial colors from its entire US retail portfolio, driven by customer demand for natural ingredients. This is seen as a pivotal move by the company and shows the continued mission to keep up with consumer needs/wants. There has also been an initiatives to cut costs by enhancing productivity and streamline operations. Over the last 5 years General Mills has seen an 11% drop over the last 5 years, but boasts a 4.5% dividend yield year over year, which has been seen by many as a safe pick for consistent guaranteed growth.

Financial Guidance for 2025:

General Mills stock is priced at approximately 53$ per share, but analysts from Bank of America are pricing in the stock at around 68$, maintaining a buy rating for the stock. Other Analysts like Goldman and Wells Fargo are aiming for a target of around 56$ due to cost pressures and tariff concerns.

While the stock has declined roughly 11% over the past 5 years, General Mills continues to appeal to income-focused investors with a 4.5% dividend yield and a track record of consistent payouts. It’s seen by many as a defensive pick in volatile markets.

Stock Outlook:

The current PE ratio of General Mills sits around 12.11, which is almost 35% lower then the average PE ratio of industry average of 17.73. In our opinion, this is a great stock to look into further and we are looking to open a position in the stock. When a PE ratio is almost 35% lower then the historic average, for a growing company like General Mills, this is very enticing, and if levels could get back to the average, this could be a great return. We do not currently own any stock in GIS but will be watching the earnings closely this week and may enter in a position.

Nike (NKE)

Earnings Date: Thursday June 26th (After market close)

Nike Inc. (NKE) is the global leader in athletic footwear, apparel, equipment and accessories, with a market cap of over 93 Billion dollars and operating in over 100 countries worldwide.

Recent Highlights:

Just under a year ago, Nike hired a new CEO with hopes to grow the company at a larger pace, but things have not turned out the way that Nike has hoped for so far. In 2019 Nike took a stand against Amazons slim margins and large cut by deciding to not sell directly through the company, but this course is being reversed by the new CEO, who looks to bring more volume to the business. One of the biggest collaborations between Nike and the Kim Kardashian brand Skims is being delayed after contract negotiations. When looking at clothing brands like Nike and Adidas, the first thing that needs to be on everyone’s mind is the guidance projection as it relates to tariffs. We expect a direct impact between tariff negotiation in China and India and the forward outlook for Nike.

Financial Guidance for 2025:

Nikes earnings this week are projecting .11$ per share, which is down over 89% year over year. Analysts are focusing on inventory issues and competition from smaller more luxury clothing brands that have seen an uptick due to tik tok trends and a wide variety of clever marketing schemes.

Stock Outlook:

It seems as if Nike has hit a wall when it comes to growth. With smaller brands catching up in terms of market share, we may continue to see bad forward outlook and nothing that excites us about the company. Down from all time highs of $160, the stock currently sits at around $60. Until tariff negotiations ease with China and a new line of clothing or shoes comes out that changes the apparel world, we are steering clear of even looking at Nike for our portfolio.

Thanks for following with us. Keep in mind we will have an analysis of one of our favorite stocks coming Tuesday and a weekly recap on Friday. In the coming weeks we will be rolling out new features to follow our portfolio and more of a deep dive into when we buy certain stock. Send us to [email protected] if you want certain stocks for us to take a look at or comments.

The content in this newsletter is for informational and educational purposes only and reflects our personal opinions, analysis, and research. It should not be considered financial advice or a recommendation to buy or sell any securities. We are not licensed financial advisors, and all investment decisions should be made based on your own due diligence and, if needed, consultation with a licensed professional. We do not accept any liability for losses incurred from investment decisions based on this content.