A warm welcome to many of you who are here that are new. We hope you had a great weekend. In this week’s update, we are going to highlight a couple stocks and give an analysis if we think they are a potential buying opportunity. If you have been following us for a while you will know that we had some great wins the past couple of weeks with $NBIS, $ORCL, and $GRAB. Congrats to our subscribers that have been following along. As we do every week in our earnings report is report on stocks that are reporting earnings this week. This is a very uneventful week in terms of earnings this week, but all eyes are on the rate cut that is expected later this week. The expectation right now on Kalashi shows a 95% chance that there will be a 25bp drop, and a 5% chance that there will be a 50bp drop. The question of the week will be whether this cut comes along with talks of more rate cuts in the future or if Powell stays hawkish with a steady eye on inflation, which still seems to be sticky. If the betting markets are correct and see do see a 25bp drop, the markets should react well initially, but the hope is that inflation does not follow in the coming months. Either way I think many economists could agree this is more than past time to cut.

Weekly Earnings Spotlight: September 15-19th, 2025:

Monday September 15th: DGNX (Diginex Limited), HKD (AMTD Digital)

Tuesday September 16th: FERG (Ferguson),

Wednesday September 17th: GIS (General Mills), BLSH (Bullish)

Thursday September 18th: FDX (Fedex), LEN (Lennar Corporation)

Fedex:

Recent Highlights

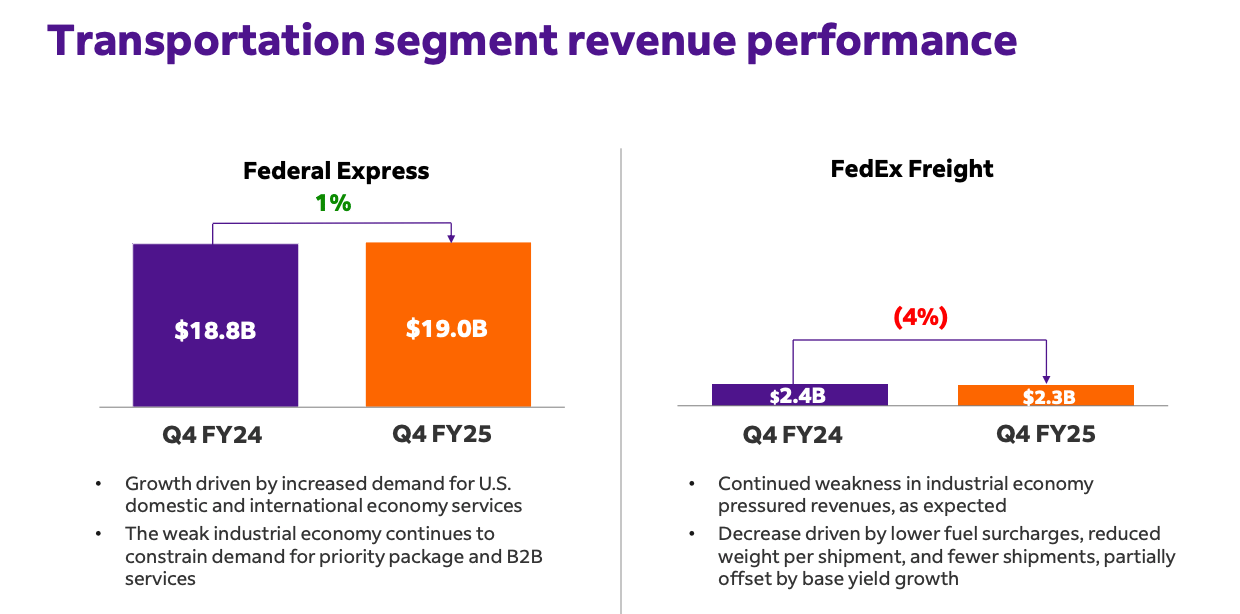

Fedex is set to release earnings on Thursday, September 18th. Analysts are expecting revenue to be around $21.7 billion with EPS around $3.71. This follows in prior quarter where they showed growth of $6.07 vs $5.41 in the prior year. Fedex is a company that does not really show explosive growth as they have been focusing on margins and restructuring. They have a new initiative called “Network 2.0” program which is aimed to consolidate operations through merging Fedex Express and Ground networks, streamline pickup and delivery processes which they are hoping will reduce cost $2 billion annually. We have looked into this new program and like this approach as it could be big potential for their stock if they are actually able achieve this cost reduction that they are going for. Shipping companies like Fedex and UPS have been hurting in the market as growth has been hard to come by as Fedex revenue growth has been sluggish as you can see from their previous quarter presentation.

Investment Thesis

We view FedEx as a steady, long-term operator in the logistics space, but not one with the kind of growth profile people might find in AI or cloud name stocks. As we have been previously preaching in out newsletters it just seems like all attention needs to be focused on Ai right now with this boom and tons of money pouring in. Fedex is a staple name, and we know that it will be around for a long time. We like their push towards cutting cost as being more operational efficiency is the answer to help them grow. If management can execute well on Network 2.0 and demonstrate tangible benefits from this big transformation, the company can drive earnings growth even if their main area of revenue now stays the same.

That said, we see a lot of real risks here. Trade policy is an ongoing and up in the air, and further tariffs or policy shifts could continue to hurt them. Costs remain higher and with flat revenue expectations, we do not see them as a stock that will have enough growth to be a good investment for now. Most analysts predict that they will stay around the price that they are now which we agree with. We think that FedEx will need to increase their AI usage into their company to see real explosive growth. We believe that the next thing Fedex will probably do is get more into robotics. Amazon has been putting lots of their money towards AI and robotics and we think it will just be a matter of time before Fedex does this to help cut costs and increase profit. We do not see them as a buy until they execute this more and are sitting on the sideline for now.

Lennar Corporation:

Analysis

Lennar, one of the biggest home building companies in the US, is set to release their Q3 2025 earnings on Thursday, September 18th. Analysts are expecting revenue around $9.0 billion, which means it would be down 4% year over year, but EPS is projected around $2-2.20 which is stronger year over year. We love looking at Lennar as they are one of the top two builders in the United States, which helps us see how the housing market is doing and consumer sentiment. Home deliveries last quarter were slightly up, but average selling prices declined. We see a similar pattern as volume held steady and grew but at lower average prices.

Lennar has elevated incentives, such as mortgage rate buy downs and discounts, which have helped maintain demand, but these cut into profitability. Their backlog of homes to be build have also been declining which means softer buyer demand. We also see from their reports that rising costs for labor, materials, and land have hurt there margins.

They have been shifting to a more “land light” model, reducing the amount of owned land on its balance sheet by relying more on option contracts and partnerships. Lennar has also been expanding into new communities, including in the Northeast, to help demand and maintain sales.

Investment Thesis

We believe Lennar remains a solid but challenged operator in the homebuilding space. The company is facing strong macroeconomic issues from increased mortgage rates and slower consumer confidence which have hurt their margins and profitability. We think that their heavy use of incentives cannot last forever which might in the end hurt them if they cannot keep increasing their sales margins in the meantime.

However their strategy through the land light model reduces risk and allows for more flexibility. We like this approach and shows that they know what they are doing during times of uncertainty. By focusing on deliveries, and controlling inventory, they are positioning themselves for recovery when interest rates hopefully go down. We thought there would be a decrease in around a basis point in interest rates before the end of 2025 which with help demand. However, with inflation increasing in this past week report we think that we may only see 25-50bp for 2025 depending in a couple more inflation numbers. Powell seems very focused on not cutting rates until he sees inflation going down. We do hope we are wrong but playing on the cautious side.

At the current price around $140 we see them as a reasonable long term investment but we do not currently own any. We do not plan to buy until maybe we see rate cuts which could not be till 2026. We are putting our money more into AI or cloud stocks as we believe in this time period they will continue to grow more in the market.

Thanks for reading along and keep an eye out for our favorite stock analysis this week. We hope you have a great week!

Growth unlocks straight to your inbox

Optimizing for growth? Go-to-Millions is Ari Murray’s ecommerce newsletter packed with proven tactics, creative that converts, and real operator insights—from product strategy to paid media. No mushy strategy. Just what’s working. Subscribe free for weekly ideas that drive revenue.

Financial News Keeps You Poor. Here's Why.

The scandalous truth: Most market news is designed to inform you about what already happened, not help you profit from what's coming next.

When CNBC reports "Stock XYZ surges 287%"—you missed it.

What you actually need:

Tomorrow's IPO calendar (not yesterday's launches)

Crowdfunding deals opening this week (not closed rounds)

What real traders are positioning for (not TV talking heads)

Economic data that moves markets (before it's released)

The financial media industrial complex profits from keeping you one step behind.

Stocks & Income flips this backwards. We focus entirely on forward-looking intel that helps you get positioned before the crowd, not informed after the move.

Stop chasing trades that happened already.

Start prepping for the next one.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

The information provided in this newsletter is for informational and educational purposes only and should not be considered financial, investment, or trading advice. While every effort has been made to ensure accuracy, we do not guarantee the completeness or reliability of the information. Past performance is not indicative of future results. You should conduct your own research or consult with a licensed financial advisor before making any investment decisions. We are not responsible for any losses that may occur from the use of this content.