Welcome!

Hope you all had a great weekend. It is crazy that it is September 1st tomorrow! As we do at the start of every week, we’ll spotlight a few companies with earnings on the horizon, recap some key developments or milestones from the past few months, and wrap up with our perspective on how we’re approaching the stock, including whether we see it as a potential buy. This week we are breaking down 2 stocks that we believe it is important to hold through earnings.

Weekly Earnings Spotlight: September 1-5th, 2025

Tuesday September 2nd: NIO Inc (NIO)

Wednesday September 3rd: Salesforce (CRM), Dollar Tree (DLTR), Figma (FIG)

Thursday September 4th: Broadcom (AVGO), Lululemon (LULU), Docusign (DOCU)

Friday September 5th: AMB Industries (AMB)

Salesforce (CRM)

Recent Highlights:

Salesforce releases their earnings on Wednesday, as they have had a challenging 2025. The stock is down 23%ish YTD however as with any almost any companies in these earnings announcements the attention will remain on the companies push into AI and its Data Cloud platform. Something that we will be looking at is their AI-driven assistant Agentforce. This came out in September of 2024, and we think it will continue to grow into their other products. Look at some of the big companies from the exhibit that have already applied Agentforce to their company which is pretty exciting. Last quarter, Salesforce posted revenue of roughly $9.8 billion, which is a 8% year over year growth. Data Cloud and AI recurring revenue has passed $1 billion, which is something that we want to see an emphasize on during this meeting. Overall, they have guidance of revenue around $10 billion, with EPS expected to be $2.76.

Our thesis:

We do really like the ongoing momentum in AI and Data Cloud, both of which appear to be gaining traction with Fortune 500 clients. We think that Salesforce will have increased competition on this front as many companies are diving into AI and Data Cloud market but remain the leader as of now. Investors sentiment is mixed, as they worry about their SaaS business (Sales, Service, Marketing Cloud) can maintain growth at the same time as the AI transition. The stock currently sits at $256, which is well below their ATH. Several price targets remain around $300, and we agree, with the expectation of them beating earnings this week.

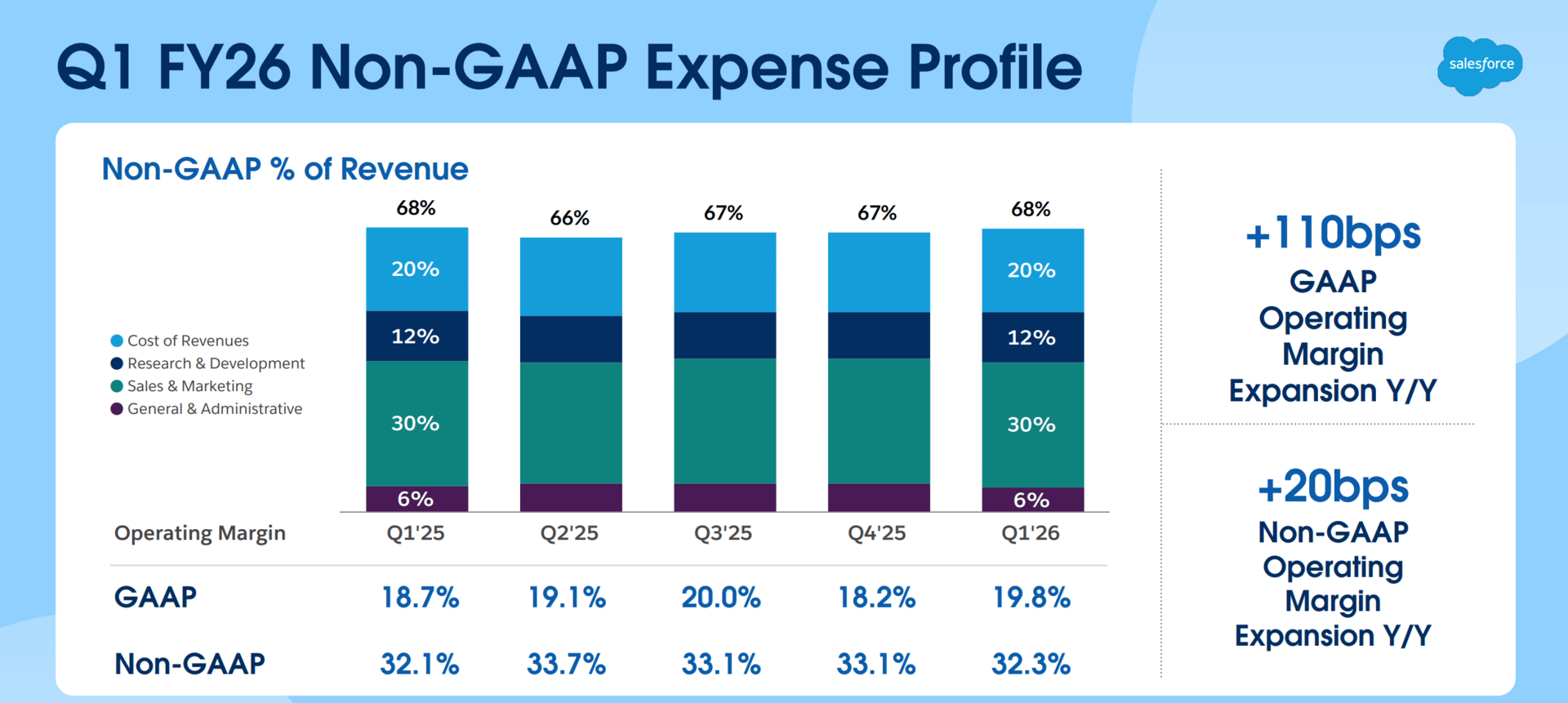

However, the biggest risk going into this earnings report, is the slowing IT spending and potential weakness in Salesforce’s core SaaS products. If they were to underperform, we do not think the AI segment will carry enough to be where they are predicted for the quarter. Something we noted from Q1 is their promise to have stronger profitability, but if costs continue to climb it will hurt investor sentiment.

The key things we will be watching in this report are whether revenue comes in above the $10.1 billion guidance, how quickly Data Cloud and AI ARR continue to grow, and what management says about full-year outlook. If Salesforce delivers an earnings beat alongside stronger-than-expected AI adoption commentary, we could see a sharp upward move in the stock. However, if the company only meets expectations without clear signs of growth, the market may continue to question whether Salesforce’s AI pivot will be enough to reignite faster growth. Wednesday will be a big day for Salesforce, and we are going to enter into a position if they provide good results on Wednesday as another long-term stock in our portfolio. We think that if their AI and Data cloud sector continue to grow while their core business stays steady that there could be a rise in the stock.

Lululemon (LULU)

Recent Highlights:

Another big stock that has earnings this week: Lululemon. They have also had a really tough 2025, being down 40%ish YTD. In Q1, Lululemon had revenue of about $2.4 billion, up 7% year over year, with EPS of around $2.60. Their big contributor to growth was international markets, particularly China. Inventory levels also moved higher, which many investors raised concerns about thinking markdowns might be coming. With tariffs continuing, we think that it will affect profitability as management warns of gross margin declines of more than 100 basis points for the year.

Stock Outlook:

After looking into what many other institutions think, the bullish case for LULU is centered on its strong international momentum and brand strength. The company also has a large share repurchase program, which could help EPS. On the other hand, the bearish case rests on a cautious consumer backdrop in the U.S., where sales growth has slowed and competition in activewear remains fierce. Tariff-related margin pressure, rising SG&A costs, and elevated inventory levels could all weigh on near-term earnings. If markdowns become necessary, profitability could take a further hit. Analysts have already lowered full-year EPS estimates, and sentiment has weakened as questions remain about whether Lululemon can reaccelerate growth.

Looking ahead to this week’s earnings, the stock reaction will likely hinge on whether management can deliver results above the $2.54 billion revenue and $2.85 EPS guidance and provide encouraging commentary on tariffs and inventory levels. Strong international results could help offset domestic softness, but if guidance is conservative or margins appear weaker than expected, Lululemon may remain under pressure in the short term.

Thesis:

Personally, we are holding Lulu through earnings. We have actually been adding to our position over the last couple of weeks in expectation for their upcoming earnings call. The biggest reason that we are holding Lulu through earnings isn’t because of the sudden turnaround we think the company will have for the long-term future, since the company has not been making crazy moves in the marketing department and the clothing that they have been pushing, but a key metric we are focused on for this quarter which is the new “No line” leggings that they recently released and have been pushing to all of their retail outlets. These pants have been flying off the shelf and we think that this could bring a large gain in their revenue and help guidance towards the end of the year. This new style of pants has been a hit on social media, and its possible lulu avid fans will want to replace all of their leggings with these new leggings. It is a long shot, but a company that has been really slacking lately will have investors eager to jump on any positive news the company might have with hopes to turn things around. Long term in such an inflated market this might be a smart stock to own, with the possible upside in these new clothing lines they are pushing might be enough to reaccelerate growth, but we personally will not be keeping a large portion of our stock, and may hold on to a small amount for a possible turnaround we are seeing with the likes of companies like Carvana.

Thanks for reading our thesis on two of the many companies releasing earnings this week and we hope you have a great start to the month!

The best HR advice comes from those in the trenches. That’s what this is: real-world HR insights delivered in a newsletter from Hebba Youssef, a Chief People Officer who’s been there. Practical, real strategies with a dash of humor. Because HR shouldn’t be thankless—and you shouldn’t be alone in it.

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

The information provided in this newsletter is for informational and educational purposes only and should not be considered financial, investment, or trading advice. While every effort has been made to ensure accuracy, we do not guarantee the completeness or reliability of the information. Past performance is not indicative of future results. You should conduct your own research or consult with a licensed financial advisor before making any investment decisions. We are not responsible for any losses that may occur from the use of this content.