Happy new year everyone. We are excited for 2026 and what is to come. We hope you had a good break and was able to get some time off. The market is somewhat quiet this week as not many big companies or any that are on our radar are releasing earnings this week. We are going to be looking more at current events in this post as there has been a lot going on this weekend and upcoming this week. As always we want to stay out of politics as much as we can but politics always collides with the stock market so we want to talk about it when something big has happened.

Venezuela

As you probably heard or saw this past weekend. According to reports the U.S. military launched a military operation in Venezuela that resulted in the capture and extradition of Nicolas Maduro and his wife on charges tied to narcotrafficking and corruption. President Trump stated that the U.S. intends to temporarily oversee Venezuela’s transition process until a new election and transfer of power can occur. He also states that United States oil companies could go into the country and drill for oil to help both economies. As with all rapidly developing geopolitical events, details may evolve, and market implications remain subject to change.

When we look at this situation it is hard to not address that Venezuela is sitting on the largest proven oil reserve in the world. However recently due to decades of mismanagement, sanctions, and infrastructure decay has drive output down to around 900-1000 kd/d, a fraction of its historical capacity. However lets just think about this for a minute. They hold nearly 300 billion barrels, at an average long term oil price of $70 per barrel, the gross value of those reserves is about $21 trillion. Even assuming only 30-40% of those barrels are economically recoverable due to heavy crude, development costs, etc that still implies around $6-8 trillion of potential long term value. If the U.S were to exert meaningful control over production and exports, whether through oversight, or U.S. company participation like Trump says will happen, it could potentially bring long term energy security over decades. Trump has said in a recent interview “We are going to have our very large US oil companies go in, spend billions of dollars, fix the broken oil infrastructure and start making money.” He also said the US will “sell large amounts of oil” pumped from Venezuela whether that to be true or not.

This could have huge implications for the United States and for the markets alone. In the short term, this disruption has caused oil prices to be higher. This is probably due to the first time this has happened and no one knows what to think which is fair.

However our current take is that where there might be short term pain or questions, long term this could be good for the market. Aside from Venezuela, Russia has some of the largest heavy crude oil reserve in the world. Tapping into Venezuela heavy crude oil reserves effectively could weaken Russias influence. With China being the biggest buyer of Venezuelan oil, this could give President Trump more control over China.

Some of the stocks that we are looking at as potential winers from this weekend are below:

Integrated producers

Chevron ($CVX)

Chevron is one of the most direct beneficiaries if Venezuelan oil is reintroduced to Western markets. The company already has legacy assets and operational history in Venezuela, giving it a potential first mover advantage if U.S. influence leads to easier sanctions. Their expertise in heavy crude, combined with big balance sheet, puts them in a good position in redevelopment efforts.

Exxon ($XOM)

We think that Exxon stand to benefit less from direct Venezuelan exposure and more so from global oil market dynamics. Long term their technical capabilities and capital discipline also could be a good pick for a large scale redevelopment projects if Venezueal stabilzes. Markets see Exxon as a beneficiary of both outcomes: sustained disruption keeps prices elevated, while eventual normalization opens the door for them.

Refiners

Valero ($VLO)

Valero is one of the best positioned refiners if Venezuelan crude flows return. Many of their refineries are optimzed for heavy sour crude, exactly the type Venezuela produces. If they got increased access to discounted heavy barrels it would improve their input costs and refining margins. Even the possibility of future Venezuela supply keeps Valero a good option as a structural winner from shifting crude trade flows.

Phillips 66 ($PSX)

Phillips benefits from both refining flexibility and their midstream exposure. Venezuelan oil returning to the U.S. markets would increase throughput opportunities and potentially improve margins at refineries capable of handling heavier blends. Also with increased crude movement it supports their logistics and transportation assets. They are not as leveraged as Valero, but they do offer a diversified way to play on this current event.

Marathon Petroleum ($MPC)

Marathon’s scale makes it a key beneficiary of any normalization in heavy crude supply. Access to Venezuelan barrels would allow MPC to optimize refinery feedstock selection, potentially lowering costs and supporting crack spreads. Markets also tend to reward MPC during periods of elevated refining margins driven by geopolitical disruptions, making it attractive both during uncertainty and eventual supply normalization.

Oil Tankers

Frontline ($FRO)

Frontline benefits from increased crude transportation demand, especially if Venezuelan exports resume or are rerouted to new buyers. Sanctions shifts, longer shipping routes, and higher utilization rates all support tanker day rates.

Scorpio Tankers ($STNG)

Scorpio is leveraged to product and crude tanker markets that benefit from disrupted trade patterns. Venezuelan oil re-entering the global system would not necessarily shorten routes in many cases but could lengthen them which would support tanker demands.

Nordic American Tankers ($NAT)

Nordic American Tankers offers more indifferent upside tied to tanker rate spikes. Any sharp increase in Venezuelan crude exports, combined with sanctions uncertainty or shifting buyers, could temporarily tighten tanker supply and lift rates. While less diversified than peers, NAT historically benefits when their is disruption similar o this that increase their tanker utilization.

Ok we get it, this is a lot of information and many different stocks to choose from. We suggest doing your own research as we are, as we see a lot of potential winners with everything that is going on. We will be staying up to date with everything and maybe do another post once they figure out how this is all going to work, which might be a while…. However we hope you have a great week and be on the look out for our analysis on the stock HIVE later this week as we break down the good vs the bad.

This newsletter is for informational and educational purposes only and reflects the personal opinions of the authors. It does not constitute financial, investment, legal, or tax advice, nor is it a recommendation or solicitation to buy, sell, or hold any securities. All views expressed are subject to change without notice. Any projections, estimates, or forward-looking statements are hypothetical in nature, based on assumptions that may not materialize, and are provided for illustrative purposes only. Actual results may differ materially. The authors may hold positions in the securities discussed and may change such positions at any time without notice. Readers should conduct their own independent research and consult with a licensed financial professional before making any investment decisions. We make no representations or warranties regarding the accuracy or completeness of the information presented and accept no liability for any losses arising from reliance on this content.

Easy setup, easy money

Your time is better spent creating content, not managing ad campaigns. Google AdSense's automatic ad placement and optimization handles the heavy lifting for you, ensuring the highest-paying, most relevant ads appear on your site.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

Attention is scarce. Learn how to earn it.

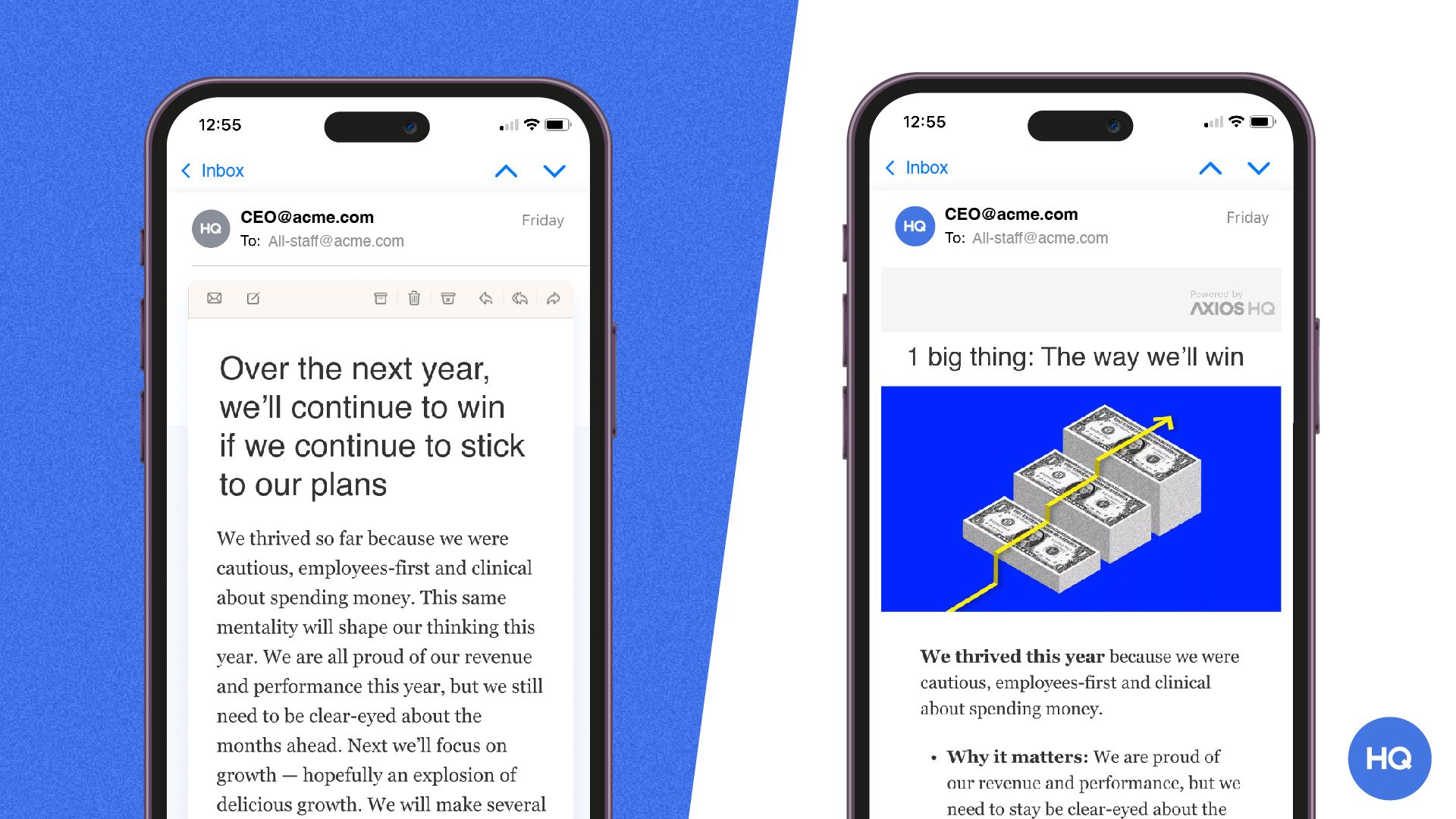

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.