Happy Wednesday and Happy Holidays! We hope you are able to enjoy some time off. The market will be closed tomorrow but today we are just going to highlight two stocks that maintain consistency that we have in our portfolio. Our investment thesis is usually built around high beta stocks, as you have seen from some of our investment theses that we have put out in the past, but its always important to diversify your portfolio when times get tough and the high beta stocks are starting to fall. Right now most have continued to rise as the AI boom continues, but when the turndown inevitably comes, it’s very nice to have consistent, recession proof stocks that can provide dividends to boost your portfolio. Today we are focusing on two recession proof industries, waste management, and credit cards, that no matter what should see consistent growth through any peaks and troughs of the economy.

Waste Management

Background

Waste Management, Inc. is the largest integrated waste, recycling, and environmental services in North America. The company offers collection, transfer, disposal and recycling and more. They have over 20 million residential, commercial, industrial, and municipal customers! Looking at where most of their revenue comes from, the majority is from collection and disposal services, around 70-75% of total revenue. Waste Management has shown consistent growth and in Q3 2025 they reported $6.4 billion in revenue, which is a healthy increase driven by pricing increases rather than volume expansion. Obviously the biggest theme behind this stock is that there will never be a garbage shortage, no matter what state the economy is in.

The WM business model is pretty straightforward. They have customers sign long term service agreements, especially in municipal and commercial contracts. Their pricing is usually a standard base service fee, with additional charges tied to volume, frequency of pickup, etc. Now let’s dive into their major announcement that they had this past December.

Major Announcement

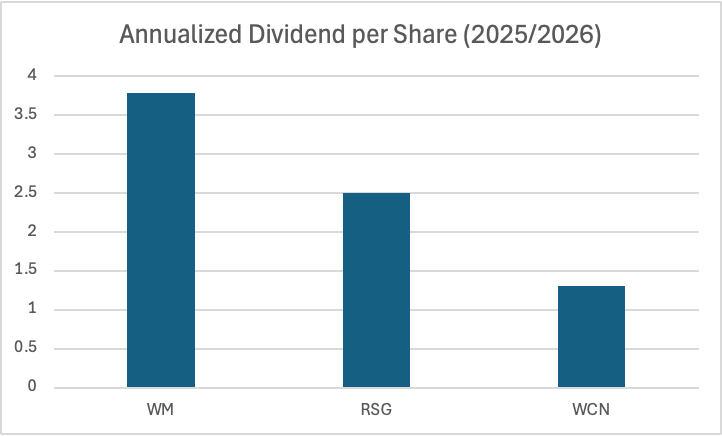

In December 2025, WM had a significant update to its capital return strategy to show management confidence in the companies long term cash flow and financial stability. The board approved a 14.5% increase in their quarterly dividend for 2026, raising it from $0.825 per share to 0.945 per share, which is $3.78 per share a year. This marks 23 consecutive years of dividend increase, which again shows their commitment to returning capital to shareholders.

As you can see from the graph above compared to their top competitors, they are winning the game in annualized dividend. As of today if you had invested 10k in WM you would have made 4.97%. This is a great defensive stock that gets you into a sector that will always need to be there. As this might not be a good major growth stock, we love being able to have a diversified portfolio in different areas in the market. Is it boring…. maybe but sometimes the most boring stocks are the ones to own. Many people believe that trash is recession proof as it is something that will always be needed, and we tend to agree.

Along with that major announcement, they also authorized a new $3 billion share repurchase program, replacing the remaining authority under its prior $1.5 billion plan. The company expects to repurchase around $2 billion of its shares during 2027. They indicate they want to return to around 90% of 2026 free cash flow to shareholders through their dividends and repurchase programs.

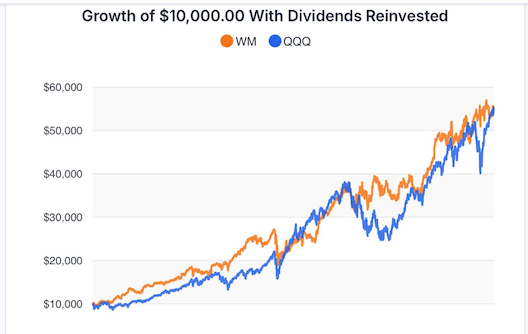

There are many areas in which Waste Management can grow. They will continue to try to grow in the renewable natural gas and carbon related business. As you can see from this chart they have matched QQQ, which has been a fund that has done better than the S&P. We see them bringing consistency to the market and as a good mix to have in your portfolio. Its a great way to hedge against the massive falls that we have seen in tech, like in 2023 for example the company did not see a stock price fall post covid, and the company was not even effected during the Trump tariffs months.

Mastercard

Summary

Mastercard, Inc. is one of the largest global payments networks in the world, operating across more than 200 countries and territories. Something that is different than normal banks is that Mastercard does not issue credit cards or take on consumer credit risk. They act as the technology backbone that connects consumers, merchants, financial institutions and get a fee every time a card is used. This makes their growth be more of a transaction volume rather than lending which is interesting.

Most of their revenue comes from payment network fees, which again are driven by the number and value of transactions processed. They also have some other core networks like fraud prevention, cybersecurity, data analytics, digital identiy, and payment optimization tools. These services that we just stated are really important to have, and even better are recurring in nature which helps carry higher margins than just traditional transaction fees.

Looking more into their earnings reports, they are very consistent just like Waste Management. They also have a dividend that sits around $3ish yearly but the stock is much more expensive than WM. However in Q3, 2025 the company reported strong revenue growth driven by global spending and cross border transactions.

Their business model is pretty straightforward. They benefit from powerful network effects, the more people that have Mastercard the more attractive the network becomes for merchants. Also long term relationships with financial institutions play a key role because merchants have a high switching cost making it more difficult to displace Mastercard once they are integrated into the payment systems. This results in predictable, recurring revenue tied to global economic activity, rather than a single customer or region.

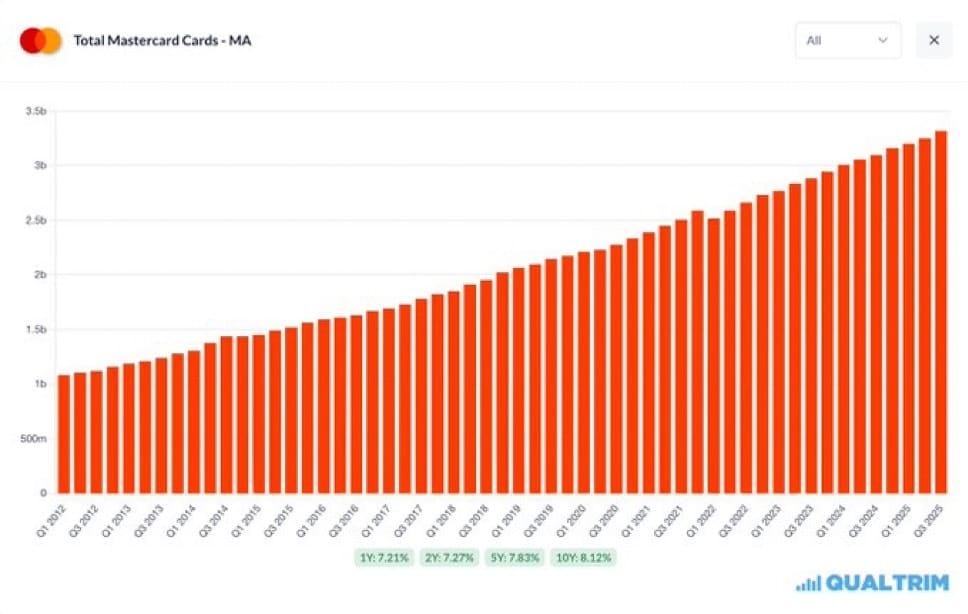

Just like WM, in December 2025, Mastercard made a notable shareholder friendly announcement, but increasing their quarterly dividend by 14% and authorizing a new $14 billion share repurchase program. This again shows their strong position in the market. As you can see this is the amount of cards that Mastercard has in throuhout the years and how dominant they are. We see Mastercard as being the key word for today consistent. While it might not be the flashiest stock there ever was, it is another sector that is good to have in a portfolio to be more balanced.

Thank you for your support and we hope you have an amazing holiday season!!

This newsletter is for informational and educational purposes only and reflects the personal opinions of the authors. It does not constitute financial, investment, legal, or tax advice, nor is it a recommendation or solicitation to buy, sell, or hold any securities. All views expressed are subject to change without notice. Any projections, estimates, or forward-looking statements are hypothetical in nature, based on assumptions that may not materialize, and are provided for illustrative purposes only. Actual results may differ materially. The authors may hold positions in the securities discussed and may change such positions at any time without notice. Readers should conduct their own independent research and consult with a licensed financial professional before making any investment decisions. We make no representations or warranties regarding the accuracy or completeness of the information presented and accept no liability for any losses arising from reliance on this content.

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

Clear communicators aren't lucky. They have a system.

Here's an uncomfortable truth: your readers give you about 26 seconds.

Smart Brevity is the methodology born in the Axios newsroom — rooted in deep respect for people's time and attention. It works just as well for internal comms, executive updates, and change management as it does for news.

We've bundled six free resources — checklists, workbooks, and more — so you can start applying it immediately.

The goal isn't shorter. It's clearer. And clearer gets results.

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.