Happy new year! We are excited for 2026 and what is to come. We think that this year could be a big year in the market. We are excited to continue to dive into our thesis of one of our favorite stocks. For this week’s stock, UIPath, is one that we have been looking into recently and think the numbers of the company are too good to leave this off one of our Weekly Stock Pick weekly newsletters. Before we begin, we want to take a quick poll amongst our newsletter readers if they would enjoy the idea of us starting a referral program that focuses on major stock thesis (5-10 pages) for stocks that we have high conviction on but may not be well known around the investing community. If you would be interest in this idea and having us release a thesis to you every 5 referrals into your inbox, please let us know below!

What is the company?

UiPath is a publicly traded enterprise software company that builds automation tools that is primarily centered around Robotic Process Automation (RPA) and advancing into agentic AI automation for businesses. Basically this means that UiPath helps organizations automate repetitive, rule-based tasks that people normally perform manually, like entering data, copying/pasting between systems, processing invoices, reconciling records, handling document flows, or running routine workflows, which helps companies turn mundane tasks into something that a computer can solve Its software can interact with user interfaces just like a human would, and is almost like a little personal AI assistant. Their technology aims to help organizations reduce manual workload, human error, and operational cost while increasing productivity and consistency in processes. Many industries, from finance and healthcare to retail and government, and even basic accounts payable accounting uses these tools to streamline all of this back office work.

The advancement of this technology has been amazing. It was originally rooted in predated rules, which was very much like any normal computer program that does exactly what its told and has no way to change, but it has been evolving toward agentic automation, which means that the AI agents help orchestrate more complex workflows and decision logic beyond strictly scripted tasks and is incorporating generative AI into its tools, which will only become more and more advanced the more information that it learns. UiPath is basically a software robot workforce that can mimic human interactions with computers.

Personally we think that this company has a killer idea. There are millions of small business owners across the country that have so many little mundane tasks that they can’t go afford to pay for someone to come in and take up a full time role and need to be paid a full time salary and payroll tax and health insurance. This company is looking to solve that problem and there is a MASSIVE demand for it.

The Numbers

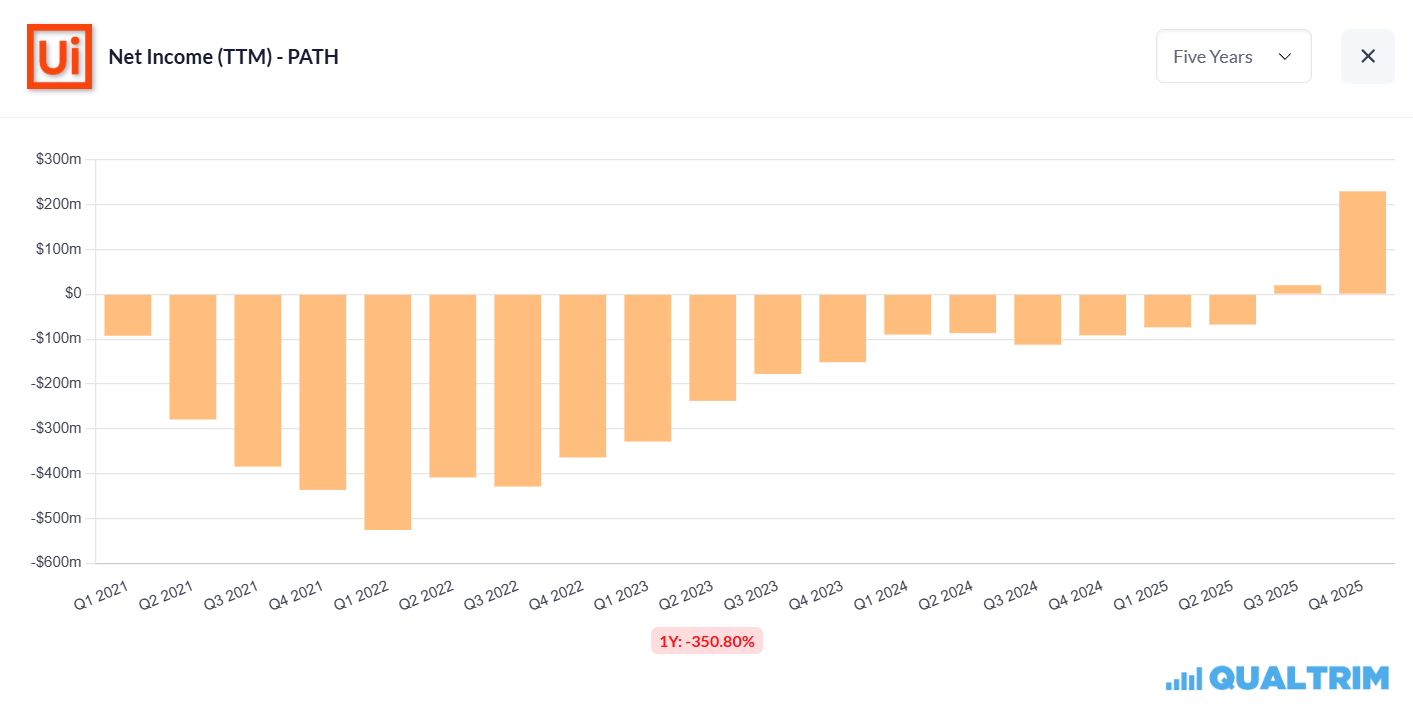

Just last quarter the company recorded revenue of $411 million, which is up 16% year-over-year. One of the main numbers that we like to focus on with companies like this one as well as companies like ZETA is annualized recurring revenue (ARR), which was $1.782 billion, up 11% from the prior year, which is showing that there is massive subscription growth. The company also just broke positive this year, which we show in the graph below. As you can see the company just broke positive on net income, which is usually a massive catalyst for these companies stock price to turn around and go on a BIG run.

One of the most interesting facts that we came across was the dollar-based net retention rate, which was 107%, which is a huge a sign of strong renewal and expansion within the existing customer base. These are VERY positive numbers from a company.

For the most recent FY 2025 Total Revenue came in at $1.43 billion, which is up 9% year-over-year. FY25 still showed a GAAP loss for the full year, even though the most recent quarter turned profitable. The revenue growth has been very very heathy, and shows no signs of slowing down any time soon. Up and to the right are always the best types of graphs for a company.

Looking ahead:

For fiscal year 2026, UiPath has publicly guided the following ranges:

Revenue: $1.571 billion – $1.576 billion, Annual Recurring Revenue (ARR): $1.834 billion – $1.839 billion, Non-GAAP operating income: $340 million These are very healthy gains for the company and we will be watching closely to see if they could hit this target

Partners:

One of the biggest things that we love to highlight in these AI company thesis newsletters is the partnerships that these companies are building. It’s a huge sign that companies are beginning to implement what the company is building and is the fastest way for companies to start bringing in meaningful revenue, which many AI companies fail to accomplish. When Nebius secured a deal with Microsoft they soared, when Iren secured a deal Meta they soared. We think that although UIPath is a little bit different in a sense that they are more like Zeta in the SaaS space, they still need to have major partners for large businesses that they believe can secure recurring revenue. UIPath has secured some major partners as of late and is only looking to expand.

Microsoft Azure is a preferred cloud platform for UiPath’s Automation Cloud, and UiPath is likewise a preferred enterprise automation partner for Microsoft — cementing a long-term strategic collaboration.

Scott Guthrie (Executive Vice President, Cloud + AI Group at Microsoft) has highlighted that the integration into Azure helps customers “reach their full potential” by leveraging both UiPath’s automation and Azure’s cloud platform capabilities across security, AI, and business applications.

Below are some more super notable customersUIPath currently has:

1. JPMorgan Chase $JPM - $844B: A global financial powerhouse using UiPath for intelligent automation, including document review (saving 360,000 hours annually), IT application testing, data extraction, and compliance.

2. Johnson & Johnson $JNJ - $498B: Healthcare giant leveraging UiPath as a key account for RPA in areas like supply chain and compliance.

3. Chevron $CVX - $303B: Energy leader using UiPath AI-powered RPA to extract unstructured data from oil and gas leases, automating exploration, operations, and back-office tasks like currency conversion and data entry.

4. Royal Bank of Canada $RY - $231B: Major bank applying UiPath for intelligent document processing, including automating sick leave systems and other back-office tasks to improve efficiency.

5. Applied Materials $AMAT - $219B: Semiconductor equipment provider scaling automation with UiPath, focusing on business-IT alignment to automate manufacturing and operational processes.

6. Thermo Fisher Scientific $TMO - $216B: Life sciences company using UiPath Document Understanding for invoice processing in finance and accounts payable, reducing time by 70% on 824,000 documents annually (53% handled without human involvement).

7. Uber $UBER - $175B: Ride-sharing innovator employing UiPath for data processing and invoicing, automating 70% of customer base billing and projecting $22 million in savings over three years.

8. Toronto-Dominion Bank $TD - $154B: Banking institution utilizing UiPath for agentic automation in lending, client onboarding, contact centers, and customer interactions to enhance operational excellence.

Here is a little bonus article that The Motley Fool published. Looks like we aren’t the only ones BULLISH!

This newsletter is provided for informational and educational purposes only and reflects the personal opinions of the authors. It does not constitute financial, investment, legal, or tax advice, nor is it intended as a recommendation or solicitation to buy, sell, or hold any securities.

All views expressed are subject to change without notice. Any projections, estimates, or forward-looking statements are hypothetical in nature, based on assumptions that may not materialize, and are provided for illustrative purposes only. Actual results may differ materially.

The authors may hold positions in the securities discussed and may change such positions at any time without notice. Readers should conduct their own independent research and consult with a licensed financial professional before making any investment decisions. No representation or warranty is made regarding the accuracy or completeness of the information provided, and no liability is accepted for losses arising from reliance on this content. This publication is not registered as an investment adviser, and the authors are not acting in any fiduciary capacity.

Easy setup, easy money

Your time is better spent creating content, not managing ad campaigns. Google AdSense's automatic ad placement and optimization handles the heavy lifting for you, ensuring the highest-paying, most relevant ads appear on your site.

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.