Welcome to the first of many newsletters!

This week is to highlight what the Big Beautiful Bill might mean for you and the everyday American. It currently sits in the senate and looks like it is going to pass.

NO TAX ON TIPS + NO TAX ON OVERTIME

The first thing people really care about: no tax on tips and no tax on overtime. Yes, these are in the bill, but they might not work exactly as you expect. Both are structured as above-the-line deductions. This means when you receive your paycheck, you’ll still pay federal income taxes on your tips or overtime earnings at that time. However, when you file your tax return, you’ll get a refund for the taxes you paid on those amounts, putting that money back in your pocket.

While it’s not ideal for taxpayers to have taxes withheld upfront on tips or overtime—especially if you rely on every dollar for bills—at least the promise was kept, and you’ll see that tax relief when you file. There’s a phase-out and a limited timeframe to know about: the deductions apply only if your income is $160,000 or less (adjusted for inflation), and they’re only in effect for tax years 2026 through 2028. After 2028, these tax breaks expire unless Congress acts to extend them.

For the 44 million Americans in tipped jobs (like servers, bartenders, or delivery drivers) and millions more earning overtime (like nurses or factory workers), these deductions could mean significant savings. For example, a waiter earning $30,000 in tips might save $3,000-$5,000 a year in taxes, depending on their bracket, once refunded. The $160,000 income cap ensures most middle-class workers qualify, but high earners in pricey cities might miss out.

NO TAX ON CAR LOAN INTEREST

Think about it—who doesn’t have a car loan these days? About 40% of Americans—roughly 132 million people—are paying off a car loan, making this provision a massive deal for so many. Just like the deductions mentioned earlier, it applies only if your income is $100,000 or less for single filers ($200,000 for joint filers), adjusted for inflation, and it’s only available for tax years 2026 through 2028.

For the millions of Americans financing U.S.-made cars (think Ford, GM, or Tesla), this deduction could save hundreds to thousands annually. For example, if you pay $5,000 in interest on a car loan, you might get back $500-$1,500 on your tax return, depending on your tax bracket. The $100,000/$200,000 income cap targets middle-class buyers, but those above the threshold miss out.

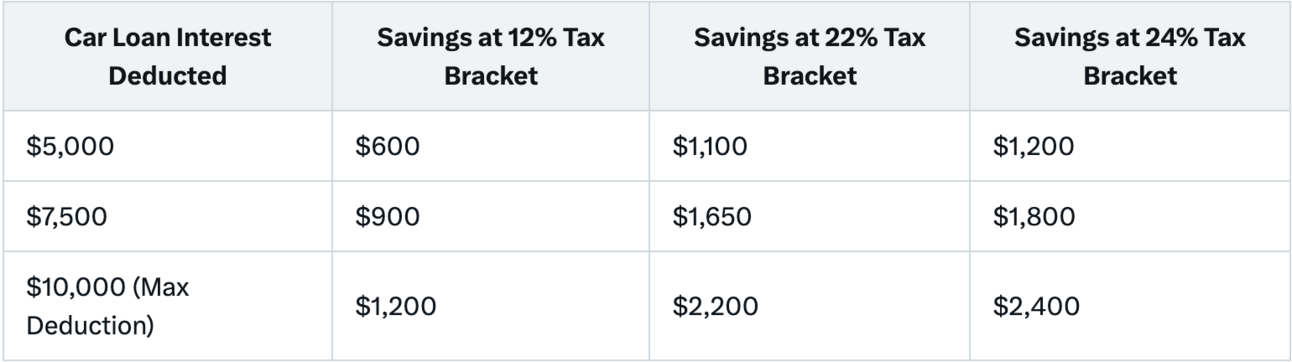

How Much Can You Save?

Here’s a quick look at potential savings for the 40% with car loans, based on your tax bracket and the amount of interest you deduct, assuming you qualify (AGI under the phase-out threshold):

Potential Savings

Some other quick things this bill will do:

Permanent Tax Cuts: The 2017 tax cuts are now permanent, saving a family of four earning $75,000 about $2,000-$3,000 yearly.

Bigger Child Tax Credit: Now $2,500 per child under 17 through 2028, helping 40 million families—an extra $1,000 for two kids!

Higher SALT Deduction: The SALT cap rises to $40,000, saving homeowners in high-tax states like CA(NY/CA) $1,500-$5,000 yearly.

Small Business Boost: A permanent 23% deduction for 45 million small businesses, which could mean more local jobs or better wages.

Job and Wage Growth: Manufacturing incentives and corporate tax cuts could create 7 million jobs, with wages potentially rising $11,600 yearly.

Whether you agree or disagree with the politics of this, it would seem that there are many things within this bill that would help the everyday American.

Again, welcome and I hope you will follow along for stock picks of the week!