FWelcome to our 30 new subscribers! We’re excited to have you with us as we continue our mission to educate and highlight some of our favorite stock picks. This week, we're doing something a little different. Normally, we spotlight one of our top short- or long-term stock ideas midweek—but today, we’re focusing on the Big Beautiful Bill.

We believe it's important to break this down because, whether you realize it or not, this legislation will likely impact you. Major tax laws like this don’t come around often, and understanding them now can save you a lot later.

We also wanted to bring to everyone’s attention our referral program at the bottom of the page. For just two referrals to your friends and family you will receive an email that grants you access to our LIVE STOCK TRACKER, where we will be logging every stock that we will be talking about on this newsletter, which will allow you to stay up to date and never miss a beat even during busy work weeks. We are up currently over 15% on our stock pick from two weeks ago $HOOD, so check it out!

🔍 What Is the Big Beautiful Bill?

The BBB is a $3.7 trillion, multi-year spending and tax overhaul passed with only Republican support. It blends fiscal responsibility with targeted investments and long-awaited structural reforms. Think of it as the most comprehensive economic legislation since the 2017 Tax Cuts and Jobs Act.

It tackles four major pillars that we will cover:

Spending reforms

Tax code changes

Healthcare and entitlement restructuring

Targeted investments and incentives

📉 1. Spending Cuts & Deficit Control

One of the bill’s primary objectives is deficit reduction. Key spending reforms include:

10% cut to non-defense discretionary spending over 3 years

Sunsetting of underused COVID-era programs

Streamlining federal grants and agency budgets, saving ~$480 billion

Defense budget growth capped at 2% annually

📌 Projected savings: ~$1.2 trillion over 10 years

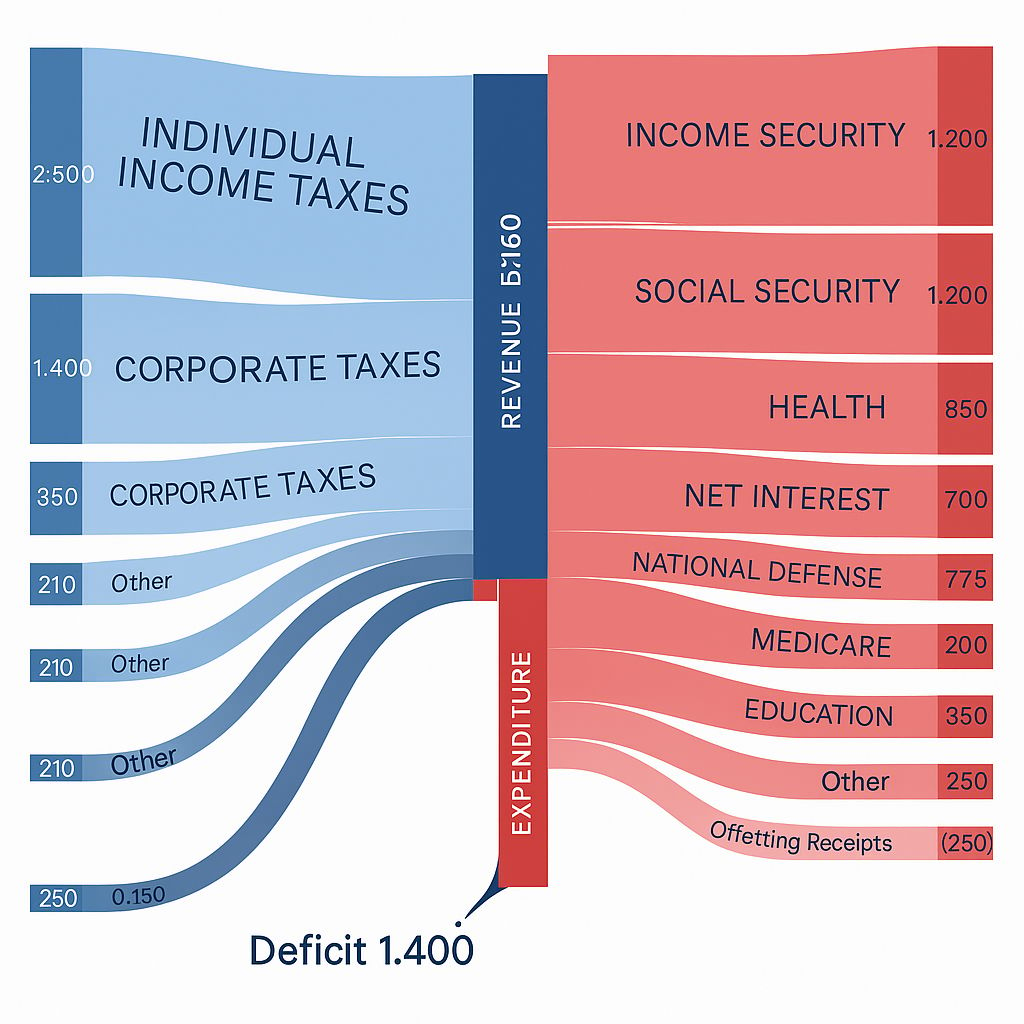

Government Income and Expenses

As we are sure that you have seen in the news, the federal deficit is increasing. While that's true, it’s important to understand why—it’s not just reckless spending. In fact, part of the reason is that the deficit is increasing is because the government is actually collecting less in taxes, meaning less revenue overall. At the same time, expenses have remained steady or even increased. That gap between lower revenue and stable (or rising) spending is what’s fueling the deficit.

To address this, the government has two choices: either raise taxes to boost revenue or cut back on spending. Without action on one of those fronts, the deficit will continue to grow which will be bad in the long run.

In our view, tax cuts are a positive for everyday Americans—they mean we’re paying less out of pocket. However, the growing deficit is something that will eventually need to be addressed.

From an investing standpoint, we’re not overly concerned about the short term or medium term effects. So far, the U.S. has shown a willingness to continue printing money to meet its obligations, which has helped stabilize markets despite the mounting debt.

💸 2. Tax Overhaul: Lower Rates, Broader Base

The tax code gets a major refresh — with an aim to stimulate growth while broadening the base:

Corporate tax rate lowered from 21% to 19% — but loopholes closed

Top individual rate remains at 37%, but standard deduction rises

Capital gains:

0% for income under $50K (96k MFJ)

15% for income up to $500K

20% + 3.8% surtax for high earners

Small business pass-through deduction made permanent

IRS enforcement budget increased to close the tax gap

📌 Goal: Encourage reinvestment and reduce tax evasion

One of the most impactful changes we’re seeing from an accounting perspective is the return of 100% bonus depreciation. This allows businesses to immediately deduct the full cost of eligible equipment purchases in the year they’re made. It’s a powerful incentive for companies to reinvest in themselves, upgrade equipment, and stimulate growth—all while reducing their tax burden.

Another major improvement is the treatment of R&D amortization. Previously, companies were required to spread out their research and development expenses over 15 years. For instance, if a business spent $15,000 on R&D, they could only deduct $1,000 per year. Under the new legislation, that entire $15,000 can now be written off in the first year.

This change is a big win for innovation. It encourages companies—especially startups and growth-stage businesses—to invest in new products and technologies, knowing they’ll get immediate tax relief. It’s a direct boost to productivity, progress, and long-term economic competitiveness.

🏥 3. Entitlement Reform (Medicaid, Medicare, and Social Security)

This was the most contentious part — but the BBB implements gradual, structural reforms that preserve core benefits:

Medicare

Raise eligibility age from 65 to 67 gradually by 2032

Means testing for Part B and D: Higher premiums for those earning $250K+

Prescription drug pricing reform expanded: Annual caps and negotiated pricing

Medicaid

Work requirements (with exceptions for disabled, elderly, and caregivers)

Expanded managed care

Telehealth reimbursement protections extended

No cuts to existing benefits

Gradual increase in payroll tax cap from $168K to $250K by 2035

New retirement savings credit for low-income workers

📌 These changes help stabilize trust funds without hitting the most vulnerable.

While you have probably heard about Medicaid rules being revamped, here is a quick full summary. Under the new Medicaid rules, able-bodied adults between the ages of 19 and 64 are now required to complete at least 80 hours per month of approved activities—such as working, job training, volunteering, or school—in order to qualify for and maintain coverage. This “community engagement” requirement is part of the federal government's effort to encourage employment and reduce long-term dependency on public assistance. States will be responsible for verifying these hours regularly, and failure to report or meet the requirement may result in a loss of coverage.

However, there are several important exemptions. Individuals who are pregnant, medically frail or disabled, or primary caregivers of young children will not be subject to the 80-hour requirement. In addition, those facing short-term hardships, like illness or lack of transportation, may also be exempt depending on their state’s rules. While the majority of Medicaid enrollees already meet these requirements or qualify for an exemption, analysts warn that millions could lose coverage due to administrative hurdles or reporting errors, not because they failed to work.

🏗️ 4. Growth Investments: Infrastructure, Tech, and Childcare

While reducing spending overall, the bill invests heavily in key growth areas:

$150B for AI, quantum, and clean energy innovation hubs

$90B for workforce development programs and trade schools

Childcare tax credit expanded and made semi-refundable

New homebuyer tax incentives aimed at Gen Z and Millennials

5. Investment Opportunity

Under the new bill, every American newborn would receive $1,000 at birth, deposited into a government-backed investment account. These funds would grow over time and could later be used for key life milestones such as education, homeownership, or starting a business.

One company already positioning itself at the forefront of this initiative is Robinhood ($HOOD). Under the leadership of CEO Vlad Tenev, Robinhood has expressed strong interest in becoming the primary platform for managing these accounts. Tenev recently stated, “I’m excited for Robinhood to offer the over 3.5 million Americans born each year the opportunity to kickstart their investing journeys.”

If adopted, this could mark a major long-term tailwind for Robinhood—potentially bringing in millions of new users from birth and solidifying its role in the future of retail investing. In our view, this development is decidedly bullish for $HOOD ( ▲ 6.82% )

🧠 What It Means for You

Middle-class families | Higher child tax credits, bigger standard deduction |

Small businesses | Permanent pass-through deduction, tax stability |

Retirees/future retirees | Entitlements are preserved but slowly adjusted |

Young professionals | New homebuyer credit, better tech/education investment |

High earners | May face higher Medicare premiums or capped deductions |

The Big Beautiful Bill is not without its flaws — but it is a serious, sweeping, and necessary piece of legislation. One of our main concerns is that it removes key advancements and support for renewable energy and clean technology, effectively rolling back many of the important provisions established by the earlier Inflation Reduction Act (IRA). Additionally, the bill significantly increases the national debt. While this may be manageable in the short term, it poses a risk for America’s economic future, as unchecked debt growth could contribute to rising inflation down the line. Addressing these issues will be critical to ensuring long-term fiscal stability.

Disclaimer: This information is provided for educational and informational purposes only and does not constitute financial, tax, or investment advice. Please consult with a qualified financial advisor, tax professional, or legal expert before making any investment or financial decisions. The views expressed are those of the author and do not reflect the official position of any company or organization. Investments carry risks, including the potential loss of principal. Past performance is not indicative of future results.

Social Security