Welcome to our new subscribers! We’re excited to have you with us as we continue our journey to educate and highlight some of our favorite stock picks. This week, we're focusing on a stock that has been pumping, up 61% year to date and is currently sitting right around all-time highs at 24$

Just a reminder once you subscribe to click confirm from your spam folder, so future newsletters gets sent to your inbox.

We wanted to bring to everyone’s attention our referral program at the bottom of the page. For just two referrals to your friends and family you will receive an email that grants you access to our LIVE STOCK TRACKER, where we will be logging every stock that we will be talking about on this newsletter, which will allow you to stay up to date and never miss a beat even during busy work weeks.

What makes SOFI so special from a business standpoint?:

SOFI stands out to us financial tech world by offering a complete digital financial platform designed for younger people. Unlike traditional banks or apps that focus on just one service, SoFi provides a wide range of financial services, including loans, credit cards, bank accounts, investing, cryptocurrency, and insurance. This means users, especially Millennials and Gen Z, can handle almost all their financial needs in one app. The hype around the company began in 2022 when SoFi became a federally chartered bank, giving it advantages over competitors like Chime and Robinhood, which depend on partner banks. SoFi claims that it aims to be a lifelong financial partner, starting with student loans and moving through home loans, investing, and retirement. The company focuses on empowerment and financial education, using social media, fun features, and learning content in the app to attract a generation wary of traditional banks. While Robinhood focuses on trading and Chime on basic banking, SoFi wants to keep users engaged across all financial stages in one seamless digital space. This approach, along with strong marketing and a high-quality digital experience, makes SoFi appealing to young consumers who value ease, transparency, and mobility in managing their finances.

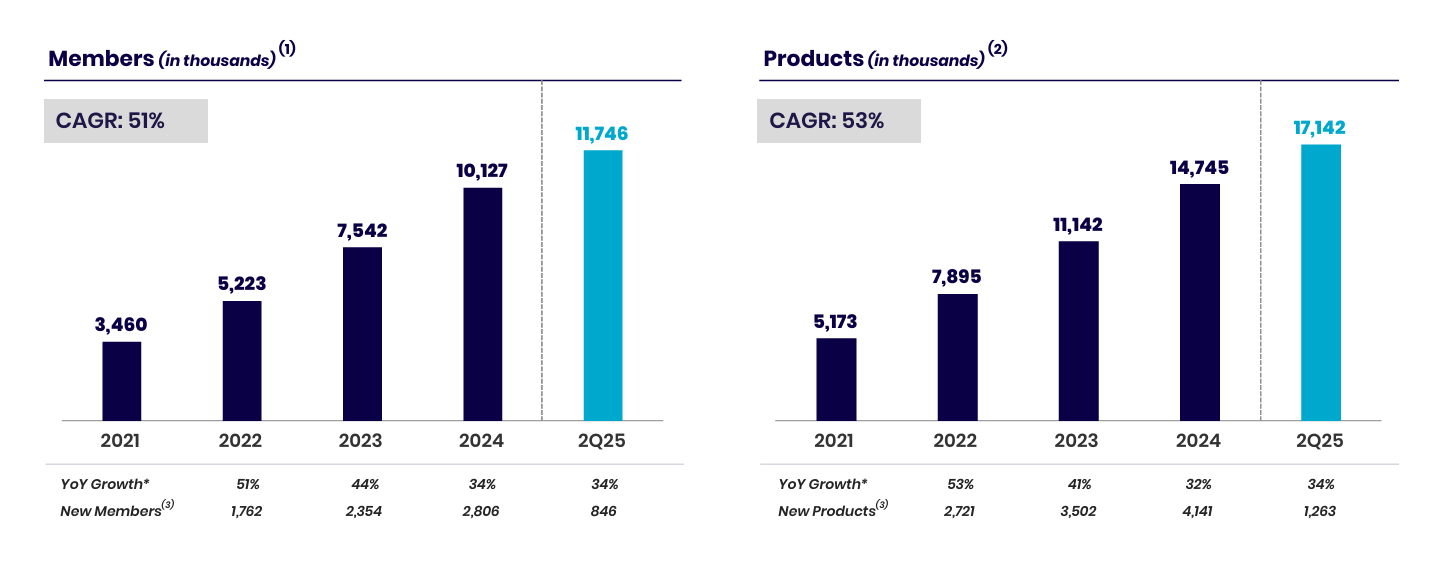

Membership Growth:

One of many things that we like to see is consistent growth. Looking at this chart from SOFI Q2 earnings, they show the Compound Annual Growth Rates (CAGR) of 51% which indicates sustained performance. Membership has risen from 3.46 million to a 11.75 million. Something that you tend to see as you get bigger as a company is having growth but it is a little slower. As you can see from 2024 to 2025 the rate of growth is the same. This is a great sign to us as it shows there is an increased user engagement and successful cross-selling across SoFi’s platform.

Positioning Themselves in times of High Volatility:

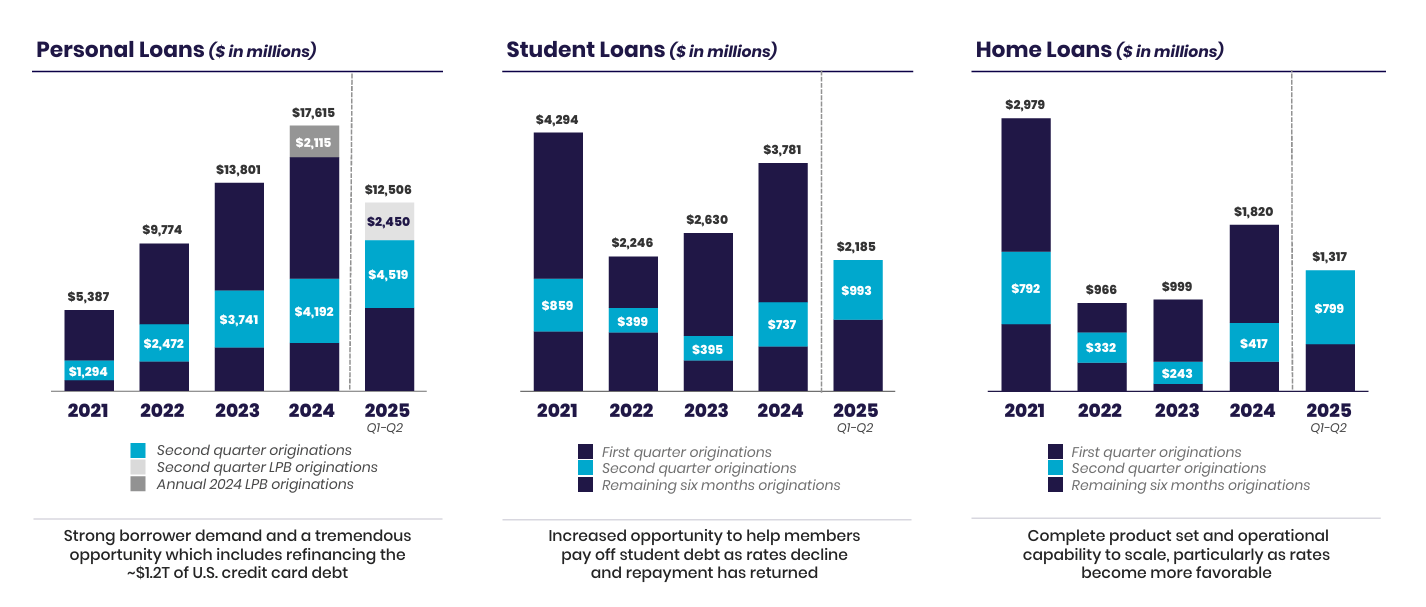

Personal Loans:

This chart clearly shows that personal loans generate the majority of SoFi’s loans. In 2024, personal loan originations reached $17.6 billion which is nearly 5x higher than student loans and 10x higher than home loans. We think this shows a big strength for SoFi as this shows that they are able to really tap into the credit card debt market of $1.2 trillion. We currently have the SoFi credit card and while there could be better cards out there, we like the 2% cash back on anything. We are able to move that money in between all of our accounts easily.

Student Loans:

As you can see from the middle chart SoFi student loans took a hit after the federal government paused repayments during COVID. It got worse when further relieve happened through the CARES Act that provided multiple extensions through 2023. However, we see this sector starting to pick back up again as the relief was lifted and people will have to start their payments again. Something that SoFi does better than any bank we see is they help younger borrowers refinance their student loans at better rates. This is easier to do through the app and most people get a lower rate than what they are offered through other providers. We really see this sector growing in the next couple of years.

Home Loans:

Although the home loans are the smallest out of the three categories, we believe that this will change soon as well. SoFi core demographic is millennials and Gen Z, who are starting to age into peak home-buying years. As the rates become more favorable (fingers-crossed) and housing demand stabilizes, we see SoFi taking off in this sector. With the infrastructure already in place, Sofi is well equipped to capitalize on this demographic and being able to then capture them into other sectors as well.

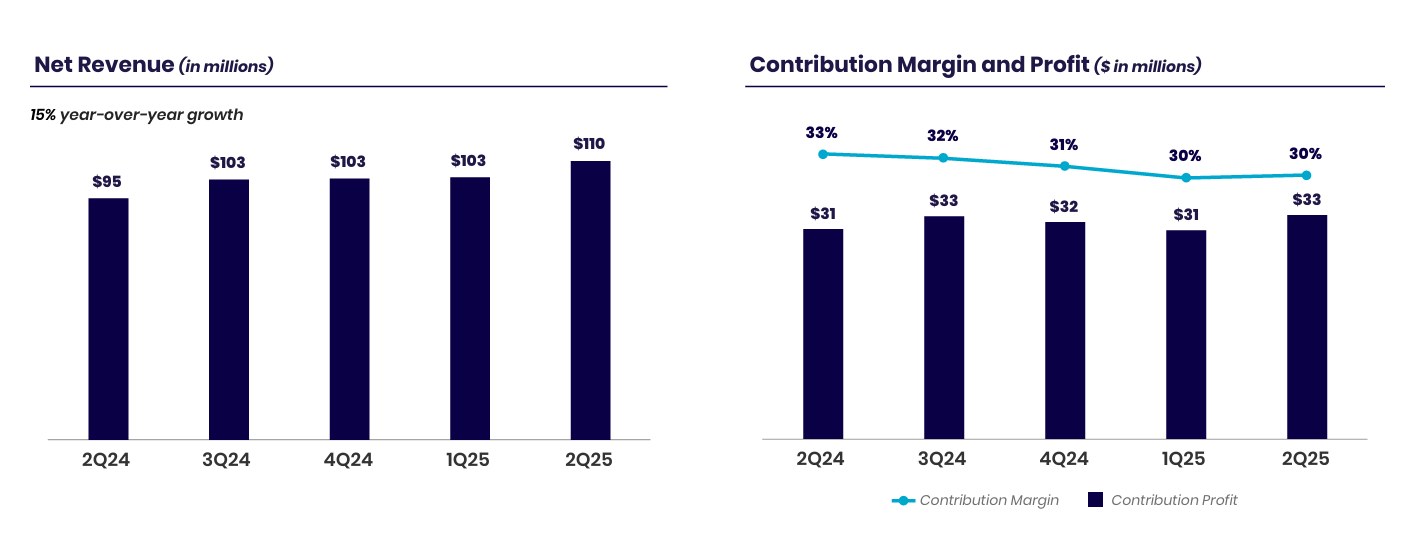

Net Revenue Continues to Rise:

This chart really demonstrates how popular SoFi is. We see that revenue grew from 95 million to 110 million in the past year which is a 15% year-over-year increase. Many fintechs struggle to maintain growth with so much competition in the market. This is a strong sign for the future.

On the right we see Sofi’s contribution margin, which is a key profitability metric. It remains strong around 30-33% over the 5 quarters. This consistency signals to use operational efficiency, meaning SoFi is not only growing top-line revenue but also maintaining solid economics. Sofi is clearly focused on sustainable growth, working to balance member acquisition and product expansion with profitability. .

Thesis:

From the first paragraph of the newsletter, we brough the attention to the ease of use of the SOFI app that felt user friendly to the next generation. This is the basis of our overall thesis of SOFI, built on the fact that we are about to witness the biggest wealth transfer in the history of the United States. The more young people who become dependent on the SOFI app for their student loans and high yield savings accounts, the more trust will be built when deciding to invest for retirement or take out a mortgage loan or just the simple attrition of wealth throughout a lifetime.

When looking at our overall thesis we also want to be cognizant of the present, and how SOFI will weather the storm of high inflation and rate cuts that may or may not come over the coming months. This is where we want to point back to earlier in the newsletter where we talk about how although SOFI does rely on home loans, the core of their business comes from personal loans and student loans. Student loans are now being forced to be paid by borrowers due to recent laws and credit card debt is at an alarming number as we went into detail on.

When interest rates stay high, yields on savings accounts on SOFI stay high. As a college student, when I was first introduced to SOFI during times of roaring inflation, I was blown away with getting 5% APY back on my money and wanted to share this with all of my friends. A “passive investment” sort of mindset that most young adults have who are busy with school and scraping away at their last dollar.

Overall, our thesis summarizing the post focuses on the next generation of wealth individuals being immersed in a user-friendly app, a very similar thesis many have surrounding Robinhood, which will foster that wealth through loans and banking and continue to grow on already very strong growth as presented in the Q2 earnings report released July 2025.

Save $499 and Skip Inventory Headaches

With tariffs rising, tracking margins is more important than ever.

inFlow makes it easy to manage inventory, costs, and shipping—all in one place. Rated 4.6 stars across 500+ reviews on Capterra

Try it free and save $499 with code EASY499—limited time only.

✅ See how others are adapting with inFlow in our case studies