Welcome back to another weekly Friday Edition of OffTheTicker! Lots of things to recap this week. We’re excited to walk you through the key market news and developments from the past few days. More importantly, we’ll break down what these events mean—and share how we’re adjusting our investments in response.

We wanted to bring to everyone’s attention our referral program at the bottom of the page. For just two referrals to your friends and family you will receive an email that grants you access to our LIVE STOCK TRACKER, where we will be logging every stock that we will be talking about on this newsletter, which will allow you to stay up to date and never miss a beat even during busy work weeks.

Palantir Gets Downgraded by Citron Research

After hitting a peak of around $190 on August 12, 2025, Palantir has dropped almost 20% over the last two weeks to about $156 by August 21, marking its sixth straight session of losses leading into today (Friday 22nd). This decline came amid a broader pullback across AI‑linked tech names, including Nvidia and others, as investor sentiment cooled following a steep run‑up earlier in the year. Palantir is seeing a bigger drop then many of these names and we think the drop may continue

The recent drop was exacerbated by a critical downgrade from Citron Research and its outspoken founder, Andrew Left. In a high‑profile short‑sell report, Citron Research labeled Palantir's valuation as wildly excessive, pointing out that even at a price of $40, based on OpenAI’s price‑to‑sales multiple of almost x17. Palantir would still be among the priciest SaaS stocks on the market. Citron’s Andrew Left warned that the stock is “detached from fundamentals and analysis,” and proposed that a smart valuation comparison would peg it near $40. Known for his aggressive short‑selling strategy, Left often targets overhyped stocks, and he's called Palantir “overhyped” and has made similarly critical bets in the past, believing the market often prices in too much optimism

Thesis:

Our Thesis on Palantir is based on a short-term waiting game of the broader market seeing a correction over the next two months, with tech and AI being at the forefront of the dip. We are predicting that QQQ will see a much larger drop then the overall S&P 500, although we expect both to see a pullback of 5-10%, which is healthy. Right now, there is a ton of market pressure like high interest rates, inflation fears, and the overall drop in consumer confidence that recently showed up in many of the major retailers’ earnings. We think that Palantir’s elevated valuation makes it especially vulnerable to steeper drops.

Many critics of Palantir, which used to include us, agreed with people like Citron’s Andrew Left that the PE ratio at this time is ridiculous and something value investors can’t fathom, but the numbers behind the company are very impressive and are setting the company up for long term success if they can retain clients and add to their client base. In 2023, Palantir generated approximately $6.5 million per client annually, even though its client base was relatively small (237 firms). In contrast, Snowflake generated just about $340,000 per customer. Along with the news this week of this downgrade, which could set us up with a very nice dip to buy into a position, Palantir won a deal with NASA for its Sole Source Contract. Any time a major tech company could secure a bid to contract with the government, there usually comes a large chunk of revenue. The details of this deal have not yet been made public, but we will keep our newsletter readers updated!

We are playing the overall dip and think Palantir could be a major faller over the next two months. We see this as a buying opportunity around the time we do see rate cuts. We will be updating our newsletter subscribers if this thesis changes. It is always important to do your own research!

Rates being cut?

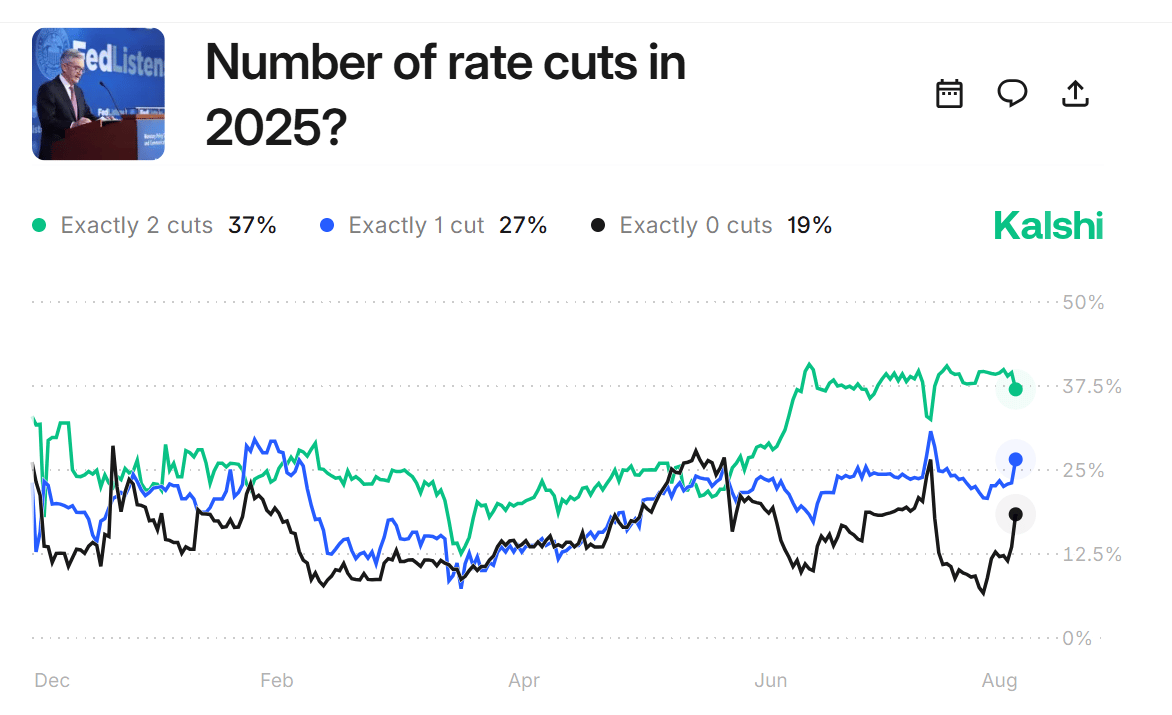

The markets have been all over the place this week with some anticipating the Federal Reserve to begin cutting interest rates as early as September, but some recent data and comments from the Fed suggest those expectations may be too optimistic. We have to agree, as growth has slowed modestly, and the main focus being on inflation. We see the rate cuts being pushed further into late 2025, if not further, depending on how the next couple rounds of CPI and employment play out.

Here is where the current numbers sit:

The chances of zero rate cuts fell to their lowest level just two weeks ago when the job numbers for the previous 2 months were adjusted down but have quickly changed course yet again after bad CPI numbers came in, as we previously spoke about on last weeks market recap. It seems like the Fed is currently in a sticky situation of trying to measure the true effects on inflation vs the consumer and labor markets. The ripple effects are already visible in the market. Growth stocks, which have benefited most from the idea of cheaper money, have led this week’s pullback, while defensive and income-generating sectors have shown relative strength. Bond yields have edged higher as traders reassess the timeline for Fed easing, and volatility has picked up ahead of Chair Jerome Powell’s highly anticipated speech at Jackson Hole. In short, the market is being forced to confront the possibility that monetary policy may remain the same well into 2025.

How we are trading around this news:

As we previously said in our Palantir thesis, we are expecting the markets to react to this situation but continuing to cut positions and institutions beginning to take profits and wait out the storm on the sideline with cash for a big drop. We think the biggest falls could come from the tech sector, which have been soaring as of late, and defense and industrial stocks might be a safe haven for investors. It also might be a great time to start looking into opening up a high yield savings account if you haven’t already done so. We spoke about SOFI High Yield Savings accounts in our Beginners to Investing Newsletter.

Walmart Misses on Earnings:

Walmart released their earnings this week missing earnings. While there revenue was better than expected, $1744 billion, up 4.8% year over year, EPS came in at 0.68 - 0.73 expected. This had a major pullback of around 4.5% in the stock. While grocery stores like Target and Walmart margins are usually under 5% profit margin, they declined even more because of the continued tariffs. We do not expect them get back to their profit margins unless they raise the price of certain products. While they missed earnings, Walmart raised their full-year sales and EPS guidance, with 3.75% expected revenue growth.

Thesis:

While Walmart is not going anywhere anytime soon, we believe there is better value out there in the market right now to be investing in. One of the stocks that we monitor a lot is Walmart because it shows us consumer spending and what the spending sentiment is. It is one way to show health of the economy so we will continue to monitor. With Walmart depending on many items not from the US, we see tariffs continuing to hurt them in the mere short term. Walmart also has a high P/E ratio, which is something we like to look at (Palantir x500). We do not see them as a buy anytime soon due to these reasons of tariffs and valuation.

Tired of compliance drama?

That enterprise deal? They just asked for SOC 2. Traditional path: 6 months, $100K.

With Delve: 15 hours. Our AI handles the busywork, and our experts help you close faster.

Lovable did it in 20 hours.

11x unlocked $2.3M.

Book a demo—code BEEHIV1K gets you $1,000 off.

Disclaimer: The information provided in this article is for informational and educational purposes only and should not be considered financial or investment advice. The opinions expressed are based on publicly available information as of August 21, 2025, and reflect the author’s personal views at that time. Investing in stocks, including Palantir, Walmart, SOFI and all others mentioned within involves risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher are not responsible for any losses or damages arising from the use of this information.