Welcome to our new subscribers! We’re excited to have you with us as we continue our journey to educate and highlight some of our favorite stock picks. This week, we're focusing on a stock that has been pumping, up over 200% the last year but still very far away from all-time highs when the stock first IPOed back in 2020, when the stock hit almost $150. At the time of this post the stock sits at around 55$, up from its all time lows of around 16$ just last year. As all of our subscribers know, we don’t take posting our weekly stock picks lightly, and all 7 of our previous stock picks are not up over 20%, and our major winners like Rigetti and Nebius going up well over 50% since the time of posting. For this weeks stock, Lemonade, we are broadening out array of companies that we want to invest in so that we could diversify our portfolio. We also want to be very clear that we think this is a long-term hold in a time where the markets are roaring and we think it may be time to diversify within the AI realm.

What is Lemonade, not the drink:

Lemonade, Inc. is a tech insurance company founded in 2015, headquartered in New York, that offers a suite of insurance products, renters, homeowners, pet, car, and term life, in the U.S. and parts of Europe. Their pitch to new customers is that you receive a straightforward answer on your insurance quote without the BS of all the administrative work and sales behind it. Lemonade handles everything via its app or web interface, from getting quotes, to underwriting, and paying claims are all streamlined and largely automated. The company markets itself as an insurer that will give you the best rates and cut out all the extra costs.

How Lemonade Stands Out:

Unlike traditional insurance firms, Lemonade has no physical branch network, relies minimally on agents or brokers, and embeds artificial intelligence and behavioral economics at the core of its business model. Legacy insurers often depend on multi-layered underwriting, manual claims processing, and inertia in legacy systems. Lemonade instead uses bots and automated systems (e.g., chatbots “Maya” for onboarding and “Jim” for claims) to reduce delays and mistakes within the system, speed approvals, and cut costs. They key takeaway that we have noted with Lemonade is that it can scale faster in new geographies without the burden of legacy infrastructure. This will allow them to eventually scale all around the world quicker than many other legacy brands.

Pricing Comparison vs Typical Insurance Companies:

Lemonade’s margin story is a tale of steep improvement, but still in a transition phase. On the loss side, Lemonade’s gross loss ratio has come down significantly: from 79% in prior periods to 67% in its Q2 2025 operations. Their adjusted gross profit margin is up to 40%, more than doubling year-over-year. That said, their combined ratio has been very high (200% in some quarters), meaning for every dollar of premium, they are spending well more than a dollar when all costs are included. Legacy insurers like Allstate, Chubb, Progressive, State Farm, Travelers etc. often run combined ratios in the 90–110% range. In those mature businesses, underwriting margins tend to be positive, and net margins are often 5-15% or higher in good years. By comparison, Lemonade is still net negative (net margin around −40% in recent periods). However, Lemonade’s improvements in loss ratio, its drop in reinsurance cession, and its AI-driven efficiencies are pushing its metrics in a direction that closed many of the gaps versus incumbents.

How Consumers see a difference:

Lemonade often quotes lower premiums for customers who have ideal or low-risk profiles, which would include good credit, clean driving record, fewer miles driven, safer location, because their AI models can more finely segment risk. For example, Lemonade’s average full-coverage car insurance quote is around $1,380 a year, which is below the national average full-coverage cost of $1,924 a year. In renters’ insurance, Lemonade often quotes $140 a year, which is about 35% below the national average. In contrast, many traditional insurers have less granular risk pricing or higher overhead and thus will charge more for many of those same low-risk consumers.

Lemonade’s rates can shift more dynamically depending on how you drive, how much you drive, when you drive, etc. For example, for auto, Lemonade uses a safety score metric to adjust renewal rates. If your usage or driving style improves, your premiums might drop. If not, they might increase more aggressively than with a legacy insurer whose rates are more stable or slower to adjust. Traditional insurers may use telematics or usage‐based discounts, but the margins and adjustment frequency tend to be less extreme.

Because Lemonade operates digitally, with less legacy agent overhead, fewer physical branches, and fewer intermediaries, their operational costs are lower in many cases. That can mean fewer extra costs embedded in premiums, underwriting loads, or commissions. Traditional insurers often have more complex expense structures, higher agent commissions, claims adjusting infrastructure, and legacy costs baked into pricing, which may get passed onto consumers.

Recent Updates that we like to see:

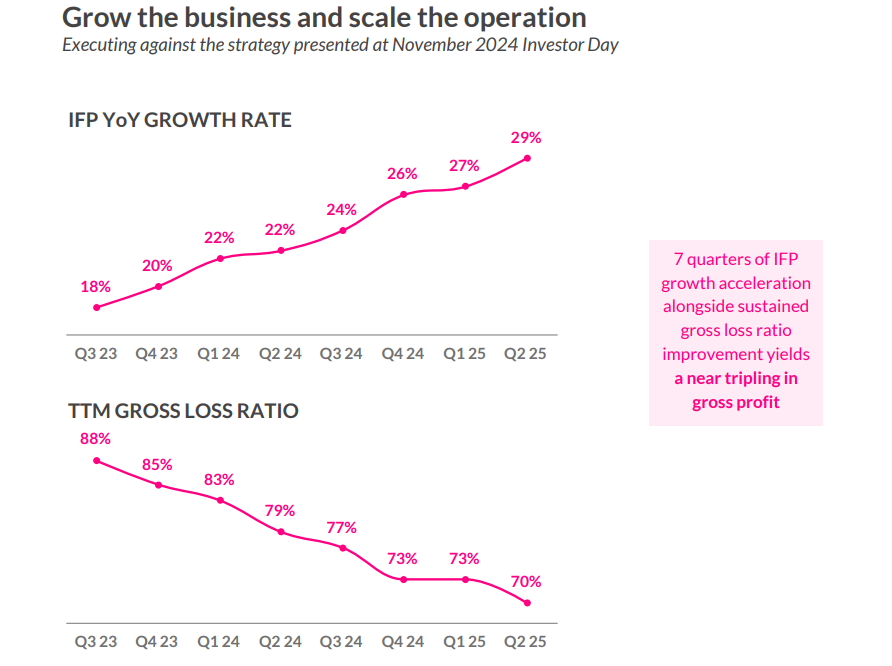

As you could see from the most recent Q2 update from the company, it doesn’t look like the company is skipping a beat when it comes to growth as well as improving on the gross loss ratio down almost 20% from 2023 with growth rate growing to around 29%. As we previously said in the first paragraph of the newsletter, we think this is a company that will start to see accelerated growth shortly and it may take some time for the adoption of this type of insurance to catch on to the new generation of home buyers and car buyers who are more familiar with AI, but the steady growth trend is there. During these earnings meeting they also announced that the company also generated $25 million in adjusted free cash flow in that quarter. On the risk side, they stated that they are reducing reliance on reinsurance from 55% to 20%, meaning they’ll retain more premium going forward. Analyst models see revenue growth rates in the high 20s to 30s percent annually. If Lemonade can maintain loss ratio improvements, keep AI costs under control, expand into new markets, and scale its product lines, it has the potential to evolve from growth to profitable scale.

Out Thesis:

Our Thesis for Lemonade is one that is rooted in the fact that we think that AI will replace everything that we do, and insurance could see a major hit. If algorithms could predict insurance premiums and learn the models that could help a company profit from insurance premiums all while keeping labor and administrative costs down, they will have a clear advantage in a trillion dollar a year industry. A lot of times when we like to give our thesis on companies, we like to connect theses between companies to arrive at an underlying approach we are taking in these stocks. The stock reminds us a lot of how SOFI is reshaping the banking industry, just instead Lemonade is doing this in the insurance industry. The new generation of home owners, car owners, term life owners are all going to be another step up when it comes to their acceptance of AI being a part of their financial lives, and having an app with a chat bot at the tip of their fingers for their insurance will make it much easier and could also save the company and the consumer money. Like we said within the newsletter, this company will take time to grow and will have to be adopted by the general public before it could really reach its full potential. In the meantime, the AI model that the company is using will only continue to gain the knowledge it needs to get more precise on the price that the company should be charging per insurance premium for all of the outside factors that a consumer might bring into the equation. We believe that one day this company should see profitability and for now we are parking a small amount of money in the stock to continue to hit all fronts of the AI boom, from banking, to insurance, to infrastructure, and even the next stop of quantum computing, we are trying to cover all of our bases and find the companies that will lead their respective industries moving forward and we don’t see any major competitors to Lemonade right now.

The best HR advice comes from people who’ve been in the trenches.

That’s what this newsletter delivers.

I Hate it Here is your insider’s guide to surviving and thriving in HR, from someone who’s been there. It’s not about theory or buzzwords — it’s about practical, real-world advice for navigating everything from tricky managers to messy policies.

Every newsletter is written by Hebba Youssef — a Chief People Officer who’s seen it all and is here to share what actually works (and what doesn’t). We’re talking real talk, real strategies, and real support — all with a side of humor to keep you sane.

Because HR shouldn’t feel like a thankless job. And you shouldn’t feel alone in it.

Financial News Keeps You Poor. Here's Why.

The scandalous truth: Most market news is designed to inform you about what already happened, not help you profit from what's coming next.

When CNBC reports "Stock XYZ surges 287%"—you missed it.

What you actually need:

Tomorrow's IPO calendar (not yesterday's launches)

Crowdfunding deals opening this week (not closed rounds)

What real traders are positioning for (not TV talking heads)

Economic data that moves markets (before it's released)

The financial media industrial complex profits from keeping you one step behind.

Stocks & Income flips this backwards. We focus entirely on forward-looking intel that helps you get positioned before the crowd, not informed after the move.

Stop chasing trades that happened already.

Start prepping for the next one.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.