Welcome!

A big shoutout to our 40 new subscribers — happy you’re joining us @OfftheTicker.

With Bitcoin back in the headlines, many investors are asking: how can I invest without the wild price swings?

This week, we’re sharing our favorite strategy for Bitcoin exposure—one that offers the potential upside without the extreme volatility. It’s a smart option for those interested in Bitcoin’s long-term value but hesitant to deal with the 24/7 trading cycle and sharp reactions to news and global events

As mentioned in our earlier piece, “Investing for Beginners: Our Three-Step Guide” (link below), we recommend allocating around 5% of your taxable brokerage account to Bitcoin. For older investors or those nearing retirement with a lower risk tolerance, we suggest exploring lower-volatility options—such as Bitcoin-focused exchange-traded funds (ETFs)—that provide more stable exposure to the asset.

The Strategy

Neos Investment, a company that that we have been following for a long time has put out many great wealth building ETFS that focus on paying out monthly dividends from actively managed funds. $BTCI ( ▼ 1.24% ) has been their flagship bitcoin ETF for a couple of months now (Inception October 16th 2024), and we are amazed by the monthly distribution of this fund as well as the fairly low expense ratio for an actively managed fund, which usually sees ratios between 1.5% to up to 2.5%.

Neos Investments publicly states that “BTCI is a fund-to-fund that seeks high monthly income with the potential for appreciation by investing in ETPs with exposure to bitcoin while utilizing call option strategies”. In simpler terms, this means that while Bitcoin experiences its normal volatility, which is around 2-4 times the volatility of the broader NYSE , the traders of BTCI are actively selling call options, which benefit greatly from volatility.

The Results So Far

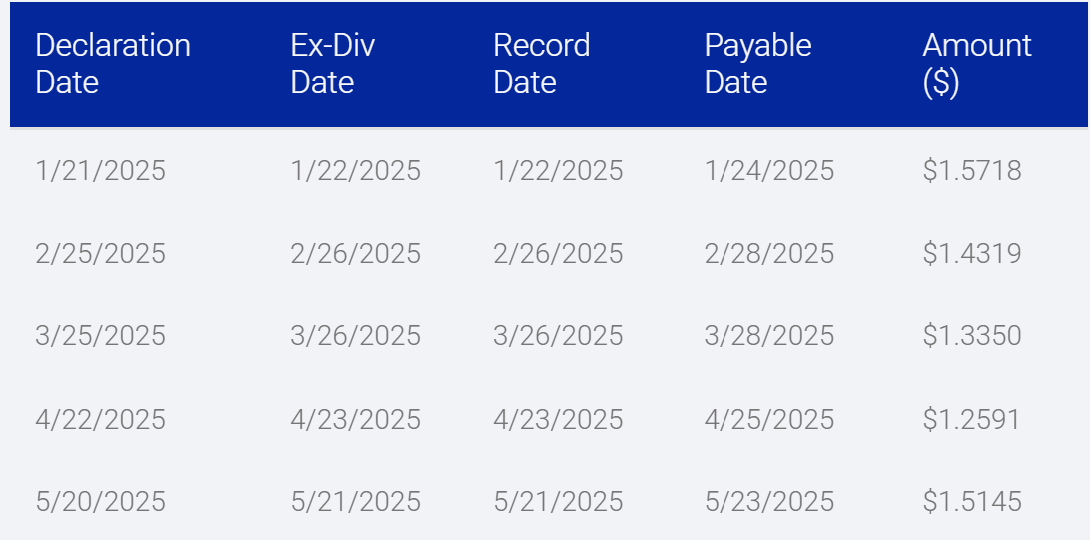

According to the NEOS website, the average monthly dividend payout for BTCI is approximately $1.423 per share. Based on the current share price of around $60, a $10,000 investment would generate roughly $240 per month in dividends—a yield of about 2.5% monthly. These dividends can either be reinvested to purchase additional shares of BTCI or used as a source of passive income. However, it's important to note that this monthly payout is not guaranteed and may fluctuate over time.

Reinvesting back In

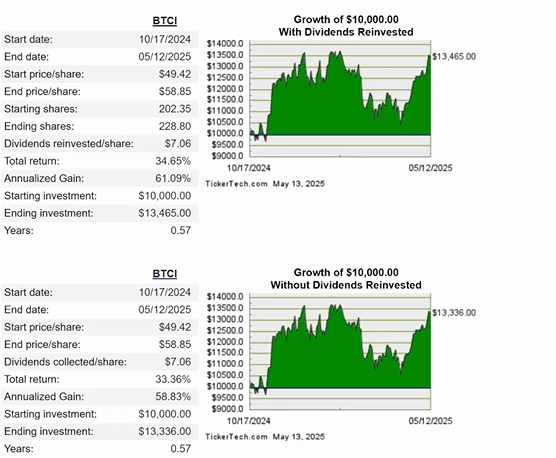

The DRIP calculator is a great way to measure the growth of an investment if all dividends were invested back into the same stock. Since the inception of this ETF, in just .57 years since March, this fund has seen an annualized growth of 61% return.

What We Do Want to Consider

The impressive annualized rate of return of 61% at the time of this analysis might initially appear to be an extraordinary figure, and it is essential to delve deeper into the context to fully understand its implications. During the period in question and the most recent analysis, Bitcoin experienced a significant increase in value, rising by nearly 71%, from $62,500 to $108,000. This substantial appreciation in Bitcoin's price is a crucial factor to consider when evaluating the potential benefits and risks of investing in BTCI.

It's important to highlight that Bitcoin has generally been on an upward trajectory since the inception of this fund. However, this consistent rise poses a challenge in predicting how the fund might perform during periods when Bitcoin's value declines. Historical performance during downturns can offer some insights, but the future remains uncertain.

If we examine the chart provided above, we can observe that during periods of decline, particularly starting from April 2025, Bitcoin reached its lowest point of the year at $80,000. Despite this downturn, the stock price of BTCI remained relatively unchanged factoring in the monthly dividends received.

How we are trading Bitcoin as an Asset

We’ve chosen to hold Bitcoin as part of our investment strategy because we believe in its long-term growth potential. In our view, Bitcoin’s value will continue to rise, particularly as the U.S. dollar faces ongoing devaluation driven by inflation and broader monetary policy decisions—both of which can erode the purchasing power of traditional currencies.

One of the things we appreciate most about our current Bitcoin exposure is the income potential. Over the past 12 months, the trailing dividend yield of BTCI has been 19.4%. While future dividends are never guaranteed on a monthly or annual basis, we’re optimistic about the potential returns this strategy can offer moving forward.

In recent weeks Bitcoin has risen to new highs, touching over $120,000 over the last week. We think that although we are seeing a massive bull run as of now, the stock could see another pull back soon. This would be a great time to dive further into research to make your own investment decision about whether Bitcoin or BTCI is a buy for you.

Thank you for reading, check out a newsletter that we are reading, and please subscribe for FREE!

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or tax advice. All investments carry risk, including the potential loss of principal. Past performance does not guarantee future results. Always do your own research or consult with a licensed financial advisor before making investment decisions.

Your boss will think you’re a genius

You’re optimizing for growth. Go-to-Millions is Ari Murray’s ecommerce newsletter packed with proven tactics, creative that converts, and real operator insights—from product strategy to paid media. No mushy strategy. Just what’s working. Subscribe free for weekly ideas that drive revenue.